PART VI—PARTICULAR PROCEEDINGS

Senate Revision Amendment

Chapters 169, 171 and 173 were renumbered "167", "169" and "171", respectively, without change in their section numbers, by Senate amendment. See 80th Congress Senate Report No. 1559.

Editorial Notes

Amendments

2014—

2010—

2000—

1998—

1996—

1995—

1992—

1990—

1982—

1980—

1966—

1960—

2 So in original. Probably should be capitalized.

CHAPTER 151 —DECLARATORY JUDGMENTS

§2201. Creation of remedy

(a) In a case of actual controversy within its jurisdiction, except with respect to Federal taxes other than actions brought under section 7428 of the Internal Revenue Code of 1986, a proceeding under

(b) For limitations on actions brought with respect to drug patents see section 505 or 512 of the Federal Food, Drug, and Cosmetic Act, or section 351 of the Public Health Service Act.

(June 25, 1948, ch. 646,

Amendment of Section

For termination of amendment by section 501(c) of

Historical and Revision Notes

1948 Act

Based on title 28, U.S.C., 1940 ed., §400 (Mar. 3, 1911, ch. 231, §274d, as added June 14, 1934, ch. 512,

This section is based on the first paragraph of

While this section does not exclude declaratory judgments with respect to State taxes, such suits will not ordinarily be entertained in the courts of the United States where State law makes provision for payment under protest and recovery back or otherwise affords adequate remedy in the State courts. See Great Lakes Dredge & Dock Co. v. Huffman, La. 1943, 63 S.Ct. 1070, 319 U.S. 293, 87 L.Ed. 1407. See also Spector Motor Service v. McLaughlin, Conn. 1944, 65 S.Ct. 152, 323 U.S. 101, 89 L.Ed. 101. See also

Changes were made in phraseology.

1949 Act

Section corrects a typographical error in

Editorial Notes

References in Text

Section 7428 of the Internal Revenue Code of 1986, referred to in subsec. (a), is classified to

Section 516A(f)(9) of the Tariff Act of 1930, referred to in subsec. (a), is classified to

Sections 505 and 512 of the Federal Food, Drug, and Cosmetic Act, referred to in subsec. (b), are classified to sections 355 and 360b, respectively, of Title 21, Food and Drugs.

Section 351 of the Public Health Service Act, referred to in subsec. (b), is classified to

Amendments

2020—Subsec. (a).

2010—Subsec. (b).

1993—Subsec. (a).

1988—Subsec. (a).

Subsec. (b).

1984—

1978—

1976—

1958—

1954—Act Aug. 28, 1954, extended provisions to Alaska.

1949—Act May 24, 1949, corrected spelling of "or" in second sentence.

Statutory Notes and Related Subsidiaries

Effective Date of 2020 Amendment

Amendment by

Effective Date of 1993 Amendment

Amendment by

Effective and Termination Dates of 1988 Amendment

Amendment by

Effective Date of 1978 Amendment

Amendment by

Effective Date of 1976 Amendment

Amendment by

Effective Date of 1958 Amendment

Amendment by

Effect of Termination of USMCA Country Status

For provisions relating to effect of termination of USMCA country status on sections 401 to 432 of

Amount in Controversy

Jurisdictional amount in diversity of citizenship cases, see

§2202. Further relief

Further necessary or proper relief based on a declaratory judgment or decree may be granted, after reasonable notice and hearing, against any adverse party whose rights have been determined by such judgment.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Based on title 28, U.S.C., 1940 ed., §400 (Mar. 3, 1911, ch. 231, §274d, as added June 14, 1934, ch. 512,

This section is based on the second paragraph of

Provision in said section 400 that the court shall require adverse parties whose rights are adjudicated to show cause why further relief should not be granted forthwith, were omitted as unnecessary and covered by the revised section.

Provisions relating to submission of interrogatories to a jury were omitted as covered by rule 49 of the Federal Rules of Civil Procedure.

Changes were made in phraseology.

CHAPTER 153 —HABEAS CORPUS

Senate Revision Amendment

Chapter catchline was changed by Senate amendment. See 80th Congress Senate Report No. 1559.

Editorial Notes

Amendments

1978—

1966—

§2241. Power to grant writ

(a) Writs of habeas corpus may be granted by the Supreme Court, any justice thereof, the district courts and any circuit judge within their respective jurisdictions. The order of a circuit judge shall be entered in the records of the district court of the district wherein the restraint complained of is had.

(b) The Supreme Court, any justice thereof, and any circuit judge may decline to entertain an application for a writ of habeas corpus and may transfer the application for hearing and determination to the district court having jurisdiction to entertain it.

(c) The writ of habeas corpus shall not extend to a prisoner unless—

(1) He is in custody under or by color of the authority of the United States or is committed for trial before some court thereof; or

(2) He is in custody for an act done or omitted in pursuance of an Act of Congress, or an order, process, judgment or decree of a court or judge of the United States; or

(3) He is in custody in violation of the Constitution or laws or treaties of the United States; or

(4) He, being a citizen of a foreign state and domiciled therein is in custody for an act done or omitted under any alleged right, title, authority, privilege, protection, or exemption claimed under the commission, order or sanction of any foreign state, or under color thereof, the validity and effect of which depend upon the law of nations; or

(5) It is necessary to bring him into court to testify or for trial.

(d) Where an application for a writ of habeas corpus is made by a person in custody under the judgment and sentence of a State court of a State which contains two or more Federal judicial districts, the application may be filed in the district court for the district wherein such person is in custody or in the district court for the district within which the State court was held which convicted and sentenced him and each of such district courts shall have concurrent jurisdiction to entertain the application. The district court for the district wherein such an application is filed in the exercise of its discretion and in furtherance of justice may transfer the application to the other district court for hearing and determination.

(e)(1) No court, justice, or judge shall have jurisdiction to hear or consider an application for a writ of habeas corpus filed by or on behalf of an alien detained by the United States who has been determined by the United States to have been properly detained as an enemy combatant or is awaiting such determination.

(2) Except as provided in paragraphs (2) and (3) of section 1005(e) of the Detainee Treatment Act of 2005 (

(June 25, 1948, ch. 646,

Historical and Revision Notes

1948 Act

Based on title 28, U.S.C., 1940 ed., §§451, 452, 453 (R.S. §§751, 752, 753; Mar. 3, 1911, ch. 231, §291,

Section consolidates

Words "for the purpose of an inquiry into the cause of restraint of liberty" in

Subsection (b) was added to give statutory sanction to orderly and appropriate procedure. A circuit judge who unnecessarily entertains applications which should be addressed to the district court, thereby disqualifies himself to hear such matters on appeal and to that extent limits his usefulness as a judge of the court of appeals. The Supreme Court and Supreme Court Justices should not be burdened with applications for writs cognizable in the district courts.

1949 Act

This section inserts commas in certain parts of the text of subsection (b) of

Editorial Notes

References in Text

Section 1005(e) of the Detainee Treatment Act of 2005, referred to in subsec. (e)(2), is section 1005(e) of title X of div. A of

Constitutionality

For information regarding the constitutionality of certain provisions of this section, as added and amended by section 1005(e)(1) of

Amendments

2008—Subsec. (e).

2006—Subsec. (e).

Subsec. (e).

2005—Subsec. (e).

1966—Subsec. (d).

1949—Subsec. (b). Act May 24, 1949, inserted commas after "Supreme Court" and "any justice thereof".

Statutory Notes and Related Subsidiaries

Effective Date of 2006 Amendment

Treaty Obligations Not Establishing Grounds for Certain Claims

"(a)

"(b)

"(1) the Convention for the Amelioration of the Condition of the Wounded and Sick in Armed Forces in the Field, done at Geneva August 12, 1949 (6 UST 3114);

"(2) the Convention for the Amelioration of the Condition of the Wounded, Sick, and Shipwrecked Members of the Armed Forces at Sea, done at Geneva August 12, 1949 (6 UST 3217);

"(3) the Convention Relative to the Treatment of Prisoners of War, done at Geneva August 12, 1949 (6 UST 3316); and

"(4) the Convention Relative to the Protection of Civilian Persons in Time of War, done at Geneva August 12, 1949 (6 UST 3516)."

§2242. Application

Application for a writ of habeas corpus shall be in writing signed and verified by the person for whose relief it is intended or by someone acting in his behalf.

It shall allege the facts concerning the applicant's commitment or detention, the name of the person who has custody over him and by virtue of what claim or authority, if known.

It may be amended or supplemented as provided in the rules of procedure applicable to civil actions.

If addressed to the Supreme Court, a justice thereof or a circuit judge it shall state the reasons for not making application to the district court of the district in which the applicant is held.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Based on title 28, U.S.C., 1940 ed., §454 (R.S. §754).

Words "or by someone acting in his behalf" were added. This follows the actual practice of the courts, as set forth in United States ex rel. Funaro v. Watchorn, C.C. 1908, 164 F. 152; Collins v. Traeger, C.C.A. 1928, 27 F.2d 842, and cases cited.

The third paragraph is new. It was added to conform to existing practice as approved by judicial decisions. See Dorsey v. Gill (App.D.C.) 148 F.2d 857, 865, 866. See also Holiday v. Johnston, 61 S.Ct. 1015, 313 U.S. 342, 85 L.Ed. 1392.

Changes were made in phraseology.

§2243. Issuance of writ; return; hearing; decision

A court, justice or judge entertaining an application for a writ of habeas corpus shall forthwith award the writ or issue an order directing the respondent to show cause why the writ should not be granted, unless it appears from the application that the applicant or person detained is not entitled thereto.

The writ, or order to show cause shall be directed to the person having custody of the person detained. It shall be returned within three days unless for good cause additional time, not exceeding twenty days, is allowed.

The person to whom the writ or order is directed shall make a return certifying the true cause of the detention.

When the writ or order is returned a day shall be set for hearing, not more than five days after the return unless for good cause additional time is allowed.

Unless the application for the writ and the return present only issues of law the person to whom the writ is directed shall be required to produce at the hearing the body of the person detained.

The applicant or the person detained may, under oath, deny any of the facts set forth in the return or allege any other material facts.

The return and all suggestions made against it may be amended, by leave of court, before or after being filed.

The court shall summarily hear and determine the facts, and dispose of the matter as law and justice require.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Based on title 28, U.S.C., 1940 ed., §§455, 456, 457, 458, 459, 460, and 461 (R.S. §§755–761).

Section consolidates

The requirement for return within 3 days "unless for good cause additional time, not exceeding 20 days is allowed" in the second paragraph, was substituted for the provision of such section 455 which allowed 3 days for return if within 20 miles, 10 days if more than 20 but not more than 100 miles, and 20 days if more than 100 miles distant.

Words "unless for good cause additional time is allowed" in the fourth paragraph, were substituted for words "unless the party petitioning requests a longer time" in

The fifth paragraph providing for production of the body of the detained person at the hearing is in conformity with Walker v. Johnston, 1941, 61 S.Ct. 574, 312 U.S. 275, 85 L.Ed. 830.

Changes were made in phraseology.

§2244. Finality of determination

(a) No circuit or district judge shall be required to entertain an application for a writ of habeas corpus to inquire into the detention of a person pursuant to a judgment of a court of the United States if it appears that the legality of such detention has been determined by a judge or court of the United States on a prior application for a writ of habeas corpus, except as provided in section 2255.

(b)(1) A claim presented in a second or successive habeas corpus application under section 2254 that was presented in a prior application shall be dismissed.

(2) A claim presented in a second or successive habeas corpus application under section 2254 that was not presented in a prior application shall be dismissed unless—

(A) the applicant shows that the claim relies on a new rule of constitutional law, made retroactive to cases on collateral review by the Supreme Court, that was previously unavailable; or

(B)(i) the factual predicate for the claim could not have been discovered previously through the exercise of due diligence; and

(ii) the facts underlying the claim, if proven and viewed in light of the evidence as a whole, would be sufficient to establish by clear and convincing evidence that, but for constitutional error, no reasonable factfinder would have found the applicant guilty of the underlying offense.

(3)(A) Before a second or successive application permitted by this section is filed in the district court, the applicant shall move in the appropriate court of appeals for an order authorizing the district court to consider the application.

(B) A motion in the court of appeals for an order authorizing the district court to consider a second or successive application shall be determined by a three-judge panel of the court of appeals.

(C) The court of appeals may authorize the filing of a second or successive application only if it determines that the application makes a prima facie showing that the application satisfies the requirements of this subsection.

(D) The court of appeals shall grant or deny the authorization to file a second or successive application not later than 30 days after the filing of the motion.

(E) The grant or denial of an authorization by a court of appeals to file a second or successive application shall not be appealable and shall not be the subject of a petition for rehearing or for a writ of certiorari.

(4) A district court shall dismiss any claim presented in a second or successive application that the court of appeals has authorized to be filed unless the applicant shows that the claim satisfies the requirements of this section.

(c) In a habeas corpus proceeding brought in behalf of a person in custody pursuant to the judgment of a State court, a prior judgment of the Supreme Court of the United States on an appeal or review by a writ of certiorari at the instance of the prisoner of the decision of such State court, shall be conclusive as to all issues of fact or law with respect to an asserted denial of a Federal right which constitutes ground for discharge in a habeas corpus proceeding, actually adjudicated by the Supreme Court therein, unless the applicant for the writ of habeas corpus shall plead and the court shall find the existence of a material and controlling fact which did not appear in the record of the proceeding in the Supreme Court and the court shall further find that the applicant for the writ of habeas corpus could not have caused such fact to appear in such record by the exercise of reasonable diligence.

(d)(1) A 1-year period of limitation shall apply to an application for a writ of habeas corpus by a person in custody pursuant to the judgment of a State court. The limitation period shall run from the latest of—

(A) the date on which the judgment became final by the conclusion of direct review or the expiration of the time for seeking such review;

(B) the date on which the impediment to filing an application created by State action in violation of the Constitution or laws of the United States is removed, if the applicant was prevented from filing by such State action;

(C) the date on which the constitutional right asserted was initially recognized by the Supreme Court, if the right has been newly recognized by the Supreme Court and made retroactively applicable to cases on collateral review; or

(D) the date on which the factual predicate of the claim or claims presented could have been discovered through the exercise of due diligence.

(2) The time during which a properly filed application for State post-conviction or other collateral review with respect to the pertinent judgment or claim is pending shall not be counted toward any period of limitation under this subsection.

(June 25, 1948, ch. 646,

Historical and Revision Notes

This section makes no material change in existing practice. Notwithstanding the opportunity open to litigants to abuse the writ, the courts have consistently refused to entertain successive "nuisance" applications for habeas corpus. It is derived from H.R. 4232 introduced in the first session of the Seventy-ninth Congress by Chairman Hatton Sumners of the Committee on the Judiciary and referred to that Committee.

The practice of suing out successive, repetitious, and unfounded writs of habeas corpus imposes an unnecessary burden on the courts. See Dorsey v. Gill, 1945, 148 F.2d 857, 862, in which Miller, J., notes that "petitions for the writ are used not only as they should be to protect unfortunate persons against miscarriages of justice, but also as a device for harassing court, custodial, and enforcement officers with a multiplicity of repetitious, meritless requests for relief. The most extreme example is that of a person who, between July 1, 1939, and April 1944 presented in the District Court 50 petitions for writs of habeas corpus; another person has presented 27 petitions; a third, 24; a fourth, 22; a fifth, 20. One hundred nineteen persons have presented 597 petitions—an average of 5."

Senate Revision Amendments

Section amended to modify original language which denied Federal judges power to entertain application for writ where legality of detention had been determined on prior application and later application presented no new grounds, and to omit reference to rehearing in section catch line and original provision authorizing hearing judge to grant rehearing. 80th Congress, Senate Report No. 1559, Amendment No. 45.

Editorial Notes

Amendments

1996—Subsec. (a).

Subsec. (b).

Subsec. (d).

1966—

§2245. Certificate of trial judge admissible in evidence

On the hearing of an application for a writ of habeas corpus to inquire into the legality of the detention of a person pursuant to a judgment the certificate of the judge who presided at the trial resulting in the judgment, setting forth the facts occurring at the trial, shall be admissible in evidence. Copies of the certificate shall be filed with the court in which the application is pending and in the court in which the trial took place.

(June 25, 1948, ch. 646,

Historical and Revision Notes

This section makes no substantive change in existing law. It is derived from H.R. 4232 introduced in the first session of the Seventy-ninth Congress by Chairman Sumners of the House Committee on the Judiciary. It clarifies existing law and promotes uniform procedure.

§2246. Evidence; depositions; affidavits

On application for a writ of habeas corpus, evidence may be taken orally or by deposition, or, in the discretion of the judge, by affidavit. If affidavits are admitted any party shall have the right to propound written interrogatories to the affiants, or to file answering affidavits.

(June 25, 1948, ch. 646,

Historical and Revision Notes

This section is derived from H.R. 4232 introduced in the first session of the Seventy-ninth Congress by Chairman Sumners of the House Committee on the Judiciary. It clarifies existing practice without substantial change.

§2247. Documentary evidence

On application for a writ of habeas corpus documentary evidence, transcripts of proceedings upon arraignment, plea and sentence and a transcript of the oral testimony introduced on any previous similar application by or in behalf of the same petitioner, shall be admissible in evidence.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Derived from H.R. 4232, Seventy-ninth Congress, first session. It is declaratory of existing law and practice.

§2248. Return or answer; conclusiveness

The allegations of a return to the writ of habeas corpus or of an answer to an order to show cause in a habeas corpus proceeding, if not traversed, shall be accepted as true except to the extent that the judge finds from the evidence that they are not true.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Derived from H.R. 4232, Seventy-ninth Congress, first session. At common law the return was conclusive and could not be controverted but it is now almost universally held that the return is not conclusive of the facts alleged therein. 39 C.J.S. pp. 664–666, §§98, 99.

§2249. Certified copies of indictment, plea and judgment; duty of respondent

On application for a writ of habeas corpus to inquire into the detention of any person pursuant to a judgment of a court of the United States, the respondent shall promptly file with the court certified copies of the indictment, plea of petitioner and the judgment, or such of them as may be material to the questions raised, if the petitioner fails to attach them to his petition, and same shall be attached to the return to the writ, or to the answer to the order to show cause.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Derived from H.R. 4232, Seventy-ninth Congress, first session. It conforms to the prevailing practice in habeas corpus proceedings.

§2250. Indigent petitioner entitled to documents without cost

If on any application for a writ of habeas corpus an order has been made permitting the petitioner to prosecute the application in forma pauperis, the clerk of any court of the United States shall furnish to the petitioner without cost certified copies of such documents or parts of the record on file in his office as may be required by order of the judge before whom the application is pending.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Derived from H.R. 4232, Seventy-ninth Congress, first session. It conforms to the prevailing practice.

§2251. Stay of State court proceedings

(a)

(1)

(2)

(3)

(b)

(June 25, 1948, ch. 646,

Historical and Revision Notes

Based on title 28, U.S.C., 1940 ed., §465 (R.S. §766; Mar. 3, 1893, ch. 226,

Provisions relating to proceedings pending in 1934 were deleted as obsolete.

A provision requiring an appeal to be taken within 3 months was omitted as covered by

Changes were made in phraseology.

Editorial Notes

Amendments

2006—

Statutory Notes and Related Subsidiaries

Effective Date of 2006 Amendment

"(1)

"(2)

§2252. Notice

Prior to the hearing of a habeas corpus proceeding in behalf of a person in custody of State officers or by virtue of State laws notice shall be served on the attorney general or other appropriate officer of such State as the justice or judge at the time of issuing the writ shall direct.

(June 25, 1948, ch. 646,

Historical and Revision Notes

Based on title 28, U.S.C., 1940 ed., §462 (R.S. §762).

Provision for making due proof of such service was omitted as unnecessary. The sheriff's or marshal's return is sufficient.

Changes were made in phraseology.

§2253. Appeal

(a) In a habeas corpus proceeding or a proceeding under section 2255 before a district judge, the final order shall be subject to review, on appeal, by the court of appeals for the circuit in which the proceeding is held.

(b) There shall be no right of appeal from a final order in a proceeding to test the validity of a warrant to remove to another district or place for commitment or trial a person charged with a criminal offense against the United States, or to test the validity of such person's detention pending removal proceedings.

(c)(1) Unless a circuit justice or judge issues a certificate of appealability, an appeal may not be taken to the court of appeals from—

(A) the final order in a habeas corpus proceeding in which the detention complained of arises out of process issued by a State court; or

(B) the final order in a proceeding under section 2255.

(2) A certificate of appealability may issue under paragraph (1) only if the applicant has made a substantial showing of the denial of a constitutional right.

(3) The certificate of appealability under paragraph (1) shall indicate which specific issue or issues satisfy the showing required by paragraph (2).

(June 25, 1948, ch. 646,

Historical and Revision Notes

1948 Act

Based on title 28, U.S.C., 1940 ed., §§463(a) and 466 (Mar. 10, 1908, ch. 76, 36 [35] Stat. 40; Feb. 13, 1925, ch. 229, §§6, 13,

This section consolidates paragraph (a) of section 463, and

The last two sentences of

Changes were made in phraseology.

1949 Act

This section corrects a typographical error in the second paragraph of

Editorial Notes

Amendments

1996—

"In a habeas corpus proceeding before a circuit or district judge, the final order shall be subject to review, on appeal, by the court of appeals for the circuit where the proceeding is had.

"There shall be no right of appeal from such an order in a proceeding to test the validity of a warrant to remove, to another district or place for commitment or trial, a person charged with a criminal offense against the United States, or to test the validity of his detention pending removal proceedings.

"An appeal may not be taken to the court of appeals from the final order in a habeas corpus proceeding where the detention complained of arises out of process issued by a State court, unless the justice or judge who rendered the order or a circuit justice or judge issues a certificate of probable cause."

1951—Act Oct. 31, 1951, substituted "to remove, to another district or place for commitment or trial, a person charged with a criminal offense against the United States, or to test the validity of his" for "of removal issued pursuant to

1949—Act May 24, 1949, substituted "3042" for "3041" in second par.

§2254. State custody; remedies in Federal courts

(a) The Supreme Court, a Justice thereof, a circuit judge, or a district court shall entertain an application for a writ of habeas corpus in behalf of a person in custody pursuant to the judgment of a State court only on the ground that he is in custody in violation of the Constitution or laws or treaties of the United States.

(b)(1) An application for a writ of habeas corpus on behalf of a person in custody pursuant to the judgment of a State court shall not be granted unless it appears that—

(A) the applicant has exhausted the remedies available in the courts of the State; or

(B)(i) there is an absence of available State corrective process; or

(ii) circumstances exist that render such process ineffective to protect the rights of the applicant.

(2) An application for a writ of habeas corpus may be denied on the merits, notwithstanding the failure of the applicant to exhaust the remedies available in the courts of the State.

(3) A State shall not be deemed to have waived the exhaustion requirement or be estopped from reliance upon the requirement unless the State, through counsel, expressly waives the requirement.

(c) An applicant shall not be deemed to have exhausted the remedies available in the courts of the State, within the meaning of this section, if he has the right under the law of the State to raise, by any available procedure, the question presented.

(d) An application for a writ of habeas corpus on behalf of a person in custody pursuant to the judgment of a State court shall not be granted with respect to any claim that was adjudicated on the merits in State court proceedings unless the adjudication of the claim—

(1) resulted in a decision that was contrary to, or involved an unreasonable application of, clearly established Federal law, as determined by the Supreme Court of the United States; or

(2) resulted in a decision that was based on an unreasonable determination of the facts in light of the evidence presented in the State court proceeding.

(e)(1) In a proceeding instituted by an application for a writ of habeas corpus by a person in custody pursuant to the judgment of a State court, a determination of a factual issue made by a State court shall be presumed to be correct. The applicant shall have the burden of rebutting the presumption of correctness by clear and convincing evidence.

(2) If the applicant has failed to develop the factual basis of a claim in State court proceedings, the court shall not hold an evidentiary hearing on the claim unless the applicant shows that—

(A) the claim relies on—

(i) a new rule of constitutional law, made retroactive to cases on collateral review by the Supreme Court, that was previously unavailable; or

(ii) a factual predicate that could not have been previously discovered through the exercise of due diligence; and

(B) the facts underlying the claim would be sufficient to establish by clear and convincing evidence that but for constitutional error, no reasonable factfinder would have found the applicant guilty of the underlying offense.

(f) If the applicant challenges the sufficiency of the evidence adduced in such State court proceeding to support the State court's determination of a factual issue made therein, the applicant, if able, shall produce that part of the record pertinent to a determination of the sufficiency of the evidence to support such determination. If the applicant, because of indigency or other reason is unable to produce such part of the record, then the State shall produce such part of the record and the Federal court shall direct the State to do so by order directed to an appropriate State official. If the State cannot provide such pertinent part of the record, then the court shall determine under the existing facts and circumstances what weight shall be given to the State court's factual determination.

(g) A copy of the official records of the State court, duly certified by the clerk of such court to be a true and correct copy of a finding, judicial opinion, or other reliable written indicia showing such a factual determination by the State court shall be admissible in the Federal court proceeding.

(h) Except as provided in section 408 of the Controlled Substances Act, in all proceedings brought under this section, and any subsequent proceedings on review, the court may appoint counsel for an applicant who is or becomes financially unable to afford counsel, except as provided by a rule promulgated by the Supreme Court pursuant to statutory authority. Appointment of counsel under this section shall be governed by

(i) The ineffectiveness or incompetence of counsel during Federal or State collateral post-conviction proceedings shall not be a ground for relief in a proceeding arising under section 2254.

(June 25, 1948, ch. 646,

Historical and Revision Notes

This new section is declaratory of existing law as affirmed by the Supreme Court. (See Ex parte Hawk, 1944, 64 S. Ct. 448, 321, U.S. 114, 88L. Ed. 572.)

Senate Revision Amendments

Senate amendment to this section, Senate Report No. 1559, amendment No. 47, has three declared purposes, set forth as follows:

"The first is to eliminate from the prohibition of the section applications in behalf of prisoners in custody under authority of a State officer but whose custody has not been directed by the judgment of a State court. If the section were applied to applications by persons detained solely under authority of a State officer it would unduly hamper Federal courts in the protection of Federal officers prosecuted for acts committed in the course of official duty.

"The second purpose is to eliminate, as a ground of Federal jurisdiction to review by habeas corpus judgments of State courts, the proposition that the State court has denied a prisoner a 'fair adjudication of the legality of his detention under the Constitution and laws of the United States.' The Judicial Conference believes that this would be an undesirable ground for Federal jurisdiction in addition to exhaustion of State remedies or lack of adequate remedy in the State courts because it would permit proceedings in the Federal court on this ground before the petitioner had exhausted his State remedies. This ground would, of course, always be open to a petitioner to assert in the Federal court after he had exhausted his State remedies or if he had no adequate State remedy.

"The third purpose is to substitute detailed and specific language for the phrase 'no adequate remedy available.' That phrase is not sufficiently specific and precise, and its meaning should, therefore, be spelled out in more detail in the section as is done by the amendment."

Editorial Notes

References in Text

Section 408 of the Controlled Substances Act, referred to in subsec. (h), is classified to

Amendments

1996—Subsec. (b).

Subsec. (d).

Subsec. (e).

Subsecs. (f), (g).

Subsecs. (h), (i).

1966—

Statutory Notes and Related Subsidiaries

Approval and Effective Date of Rules Governing Section 2254 Cases and Section 2255 Proceedings for United States District Courts

For approval and effective date of rules governing petitions under section 2254 and motions under

Postponement of Effective Date of Proposed Rules Governing Proceedings Under Sections 2254 and 2255 of this Title

Rules and forms governing proceedings under

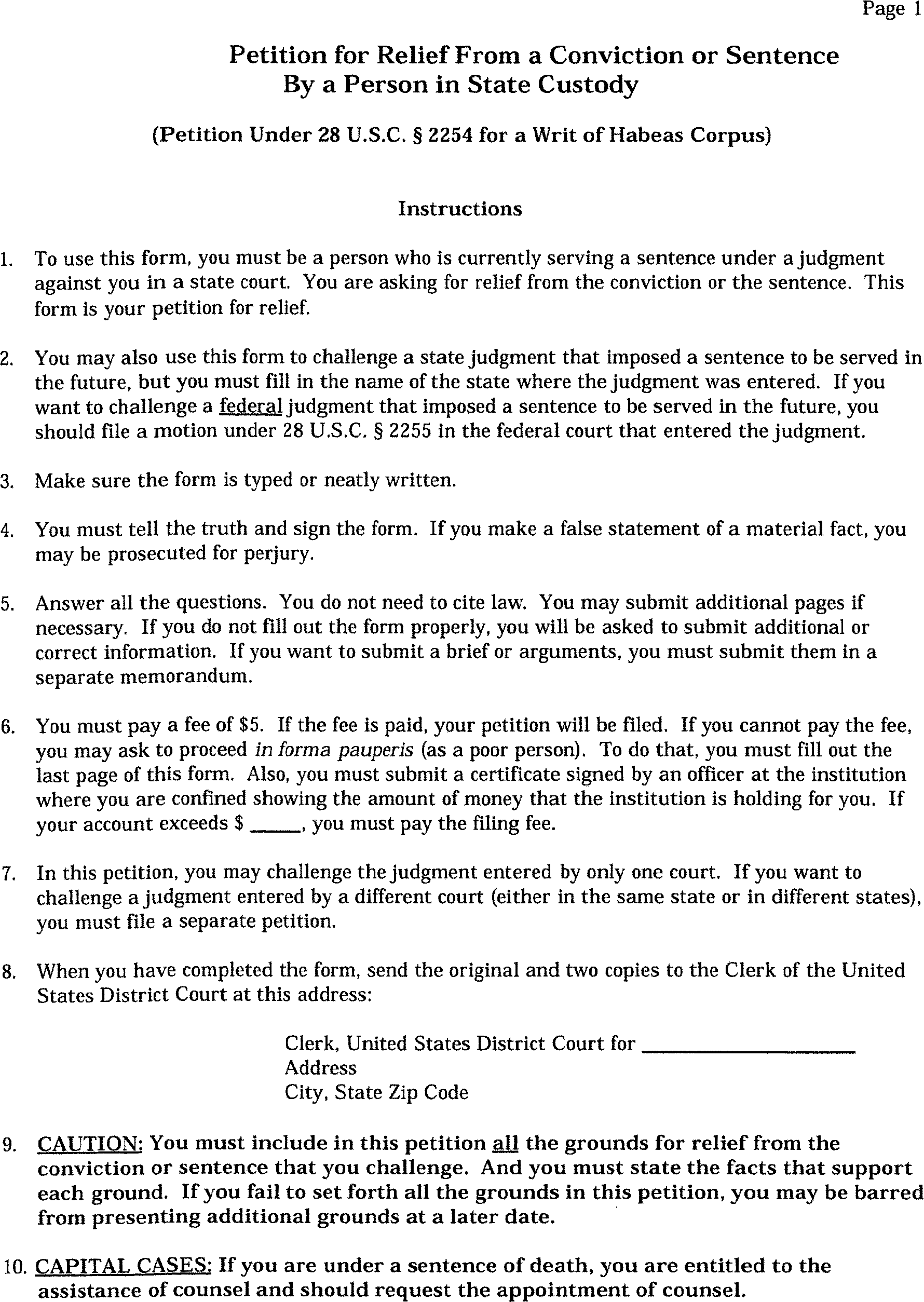

RULES GOVERNING SECTION 2254 CASES IN THE UNITED STATES DISTRICT COURTS

(Effective Feb. 1, 1977, as amended to Jan. 2, 2024)

APPENDIX OF FORMS

Petition Under 28 U.S.C. §2254 for Writ of Habeas Corpus By a Person in State Custody.

Effective Date of Rules; Effective Date of 1975 Amendment

Rules governing Section 2254 cases, and the amendments thereto by

Rule 1. Scope

(a)

(1) a person in custody under a state-court judgment who seeks a determination that the custody violates the Constitution, laws, or treaties of the United States; and

(2) a person in custody under a state-court or federal-court judgment who seeks a determination that future custody under a state-court judgment would violate the Constitution, laws, or treaties of the United States.

(b)

(As amended Apr. 26, 2004, eff. Dec. 1, 2004.)

Advisory Committee Note

Rule 1 provides that the habeas corpus rules are applicable to petitions by persons in custody pursuant to a judgment of a state court. See Preiser v. Rodriguez, 411 U.S. 475, 484 (1973). Whether the rules ought to apply to other situations (e.g., person in active military service, Glazier v. Hackel, 440 F.2d 592 (9th Cir. 1971); or a reservist called to active duty but not reported, Hammond v. Lenfest, 398 F.2d 705 (2d Cir. 1968)) is left to the discretion of the court.

The basic scope of habeas corpus is prescribed by statute. 28 U.S.C. §2241(c) provides that the "writ of habeas corpus shall not extend to a prisoner unless * * * (h)e is in custody in violation of the Constitution." 28 U.S.C. §2254 deals specifically with state custody, providing that habeas corpus shall apply only "in behalf of a person in custody pursuant to a judgment of a state court * * *."

In Preiser v. Rodriguez, supra, the court said: "It is clear . . . that the essence of habeas corpus is an attack by a person in custody upon the legality of that custody, and that the traditional function of the writ is to secure release from illegal custody." 411 U.S. at 484.

Initially the Supreme Court held that habeas corpus was appropriate only in those situations in which petitioner's claim would, if upheld, result in an immediate release from a present custody. McNally v. Hill, 293 U.S. 131 (1934). This was changed in Peyton v. Rowe, 391 U.S. 54 (1968), in which the court held that habeas corpus was a proper way to attack a consecutive sentence to be served in the future, expressing the view that consecutive sentences resulted in present custody under both judgments, not merely the one imposing the first sentence. This view was expanded in Carafas v. LaVallee, 391 U.S. 234 (1968), to recognize the propriety of habeas corpus in a case in which petitioner was in custody when the petition had been originally filed but had since been unconditionally released from custody.

See also Preiser v. Rodriguez, 411 U.S. at 486 et seq.

Since Carafas, custody has been construed more liberally by the courts so as to make a §2255 motion or habeas corpus petition proper in more situations. "In custody" now includes a person who is: on parole, Jones v. Cunningham, 371 U.S. 236 (1963); at large on his own recognizance but subject to several conditions pending execution of his sentence, Hensley v. Municipal Court, 411 U.S. 345 (1973); or released on bail after conviction pending final disposition of his case, Lefkowitz v. Newsome, 95 S.Ct. 886 (1975). See also United States v. Re, 372 F.2d 641 (2d Cir.), cert. denied, 388 U.S. 912 (1967) (on probation); Walker v. North Carolina, 262 F.Supp. 102 (W.D.N.C. 1966), aff'd per curiam, 372 F.2d 129 (4th Cir.), cert. denied, 388 U.S. 917 (1967) (recipient of a conditionally suspended sentence); Burris v. Ryan, 397 F.2d 553 (7th Cir. 1968); Marden v. Purdy, 409 F.2d 784 (5th Cir. 1969) (free on bail); United States ex rel. Smith v. Dibella, 314 F.Supp. 446 (D.Conn. 1970) (release on own recognizance); Choung v. California, 320 F.Supp. 625 (E.D.Cal. 1970) (federal stay of state court sentence); United States ex rel. Meadows v. New York, 426 F.2d 1176 (2d Cir. 1970), cert. denied, 401 U.S. 941 (1971) (subject to parole detainer warrant); Capler v. City of Greenville, 422 F.2d 299 (5th Cir. 1970) (released on appeal bond); Glover v. North Carolina, 301 F.Supp. 364 (E.D.N.C. 1969) (sentence served, but as convicted felon disqualified from engaging in several activities).

The courts are not unanimous in dealing with the above situations, and the boundaries of custody remain somewhat unclear. In Morgan v. Thomas, 321 F.Supp. 565 (S.D.Miss. 1970), the court noted:

It is axiomatic that actual physical custody or restraint is not required to confer habeas jurisdiction. Rather, the term is synonymous with restraint of liberty. The real question is how much restraint of one's liberty is necessary before the right to apply for the writ comes into play. * * *

It is clear however, that something more than moral restraint is necessary to make a case for habeas corpus.

321 F.Supp. at 573

Hammond v. Lenfest, 398 F.2d 705 (2d Cir. 1968), reviewed prior "custody" doctrine and reaffirmed a generalized flexible approach to the issue. In speaking about 28 U.S.C. §2241, the first section in the habeas corpus statutes, the court said:

While the language of the Act indicates that a writ of habeas corpus is appropriate only when a petitioner is "in custody," * * * the Act "does not attempt to mark the boundaries of 'custody' nor in any way other than by use of that word attempt to limit the situations in which the writ can be used." * * * And, recent Supreme Court decisions have made clear that "[i]t [habeas corpus] is not now and never has been a static, narrow, formalistic remedy; its scope has grown to achieve its grand purpose—the protection of individuals against erosion of their right to be free from wrongful restraints upon their liberty." * * * "[B]esides physical imprisonment, there are other restraints on a man's liberty, restraints not shared by the public generally, which have been thought sufficient in the English-speaking world to support the issuance of habeas corpus."

398 F.2d at 710–711

There is, as of now, no final list of the situations which are appropriate for habeas corpus relief. It is not the intent of these rules or notes to define or limit "custody."

It is, however, the view of the Advisory Committee that claims of improper conditions of custody or confinement (not related to the propriety of the custody itself), can better be handled by other means such as 42 U.S.C. §1983 and other related statutes. In Wilwording v. Swanson, 404 U.S. 249 (1971), the court treated a habeas corpus petition by a state prisoner challenging the conditions of confinement as a claim for relief under 42 U.S.C. §1983, the Civil Rights Act. Compare Johnson v. Avery, 393 U.S. 483 (1969).

The distinction between duration of confinement and conditions of confinement may be difficult to draw. Compare Preiser v. Rodriguez, 411 U.S. 475 (1973), with Clutchette v. Procunier, 497 F.2d 809 (9th Cir. 1974), modified, 510 F.2d 613 (1975).

Committee Notes on Rules—2004 Amendment

The language of Rule 1 has been amended as part of general restyling of the rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic and no substantive change is intended.

Changes Made After Publication and Comments. In response to at least one commentator on the published rules, the Committee modified Rule 1(b) to reflect the point that if the court was considering a habeas petition not covered by §2254, the court could apply some or all of the rules.

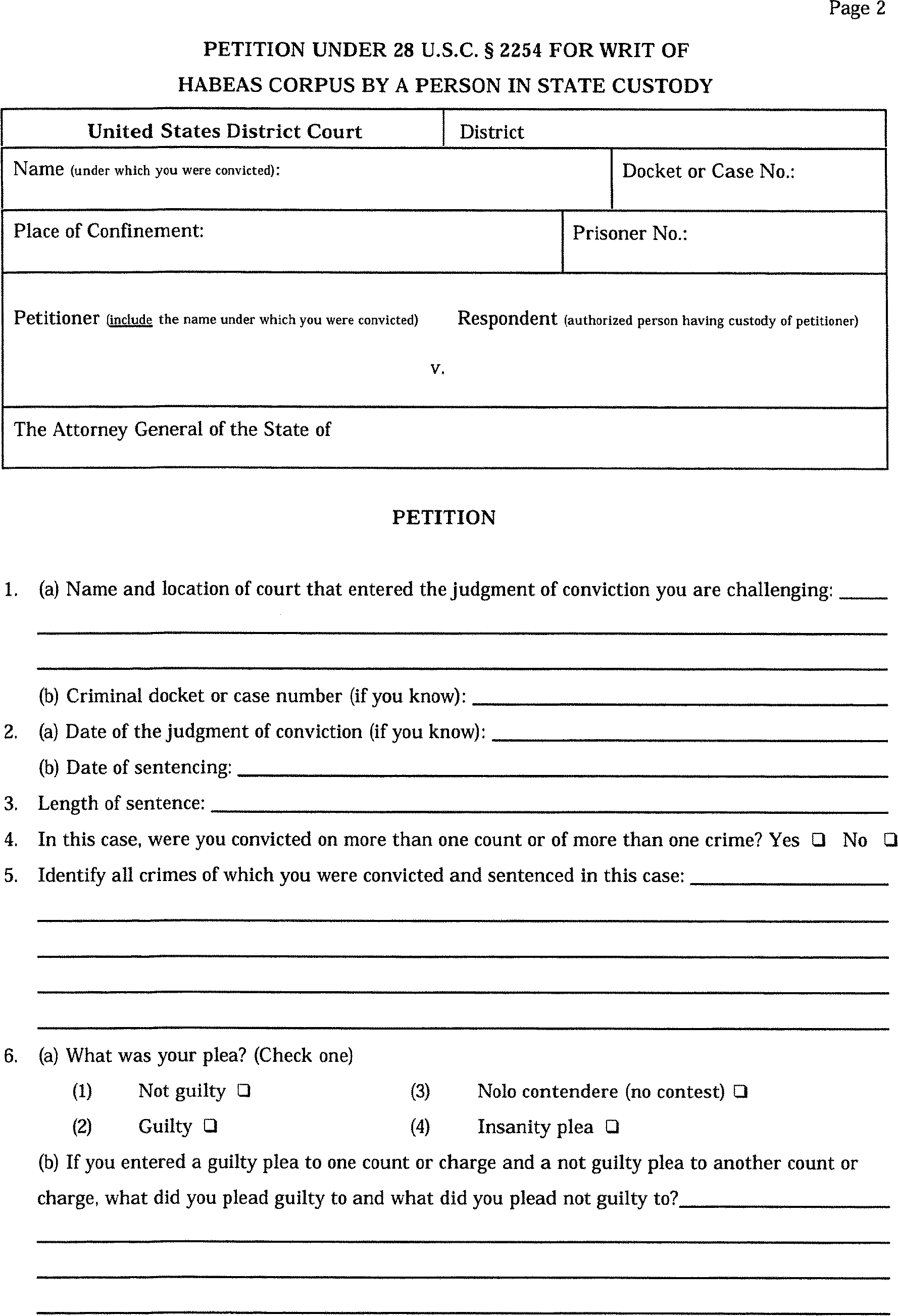

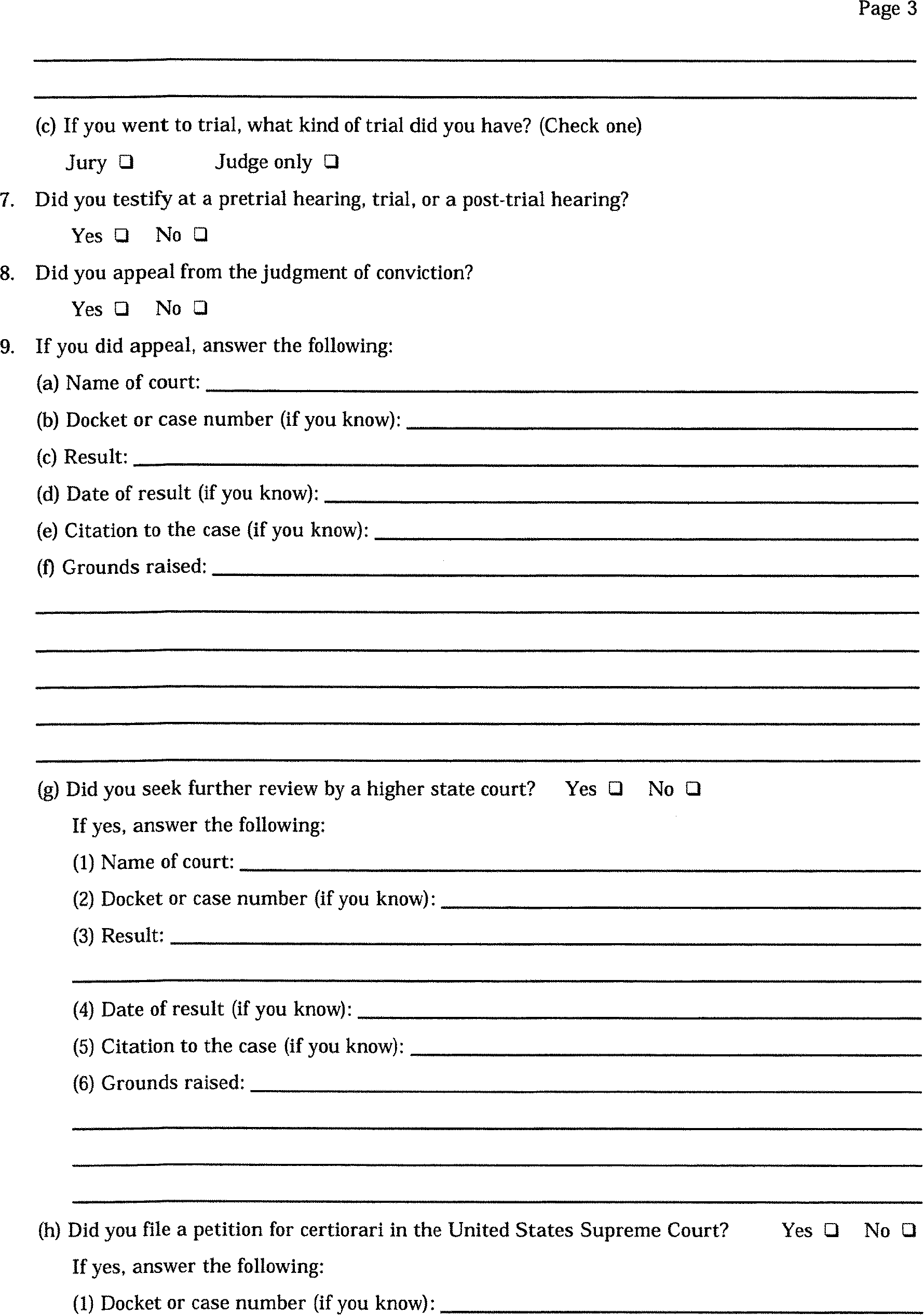

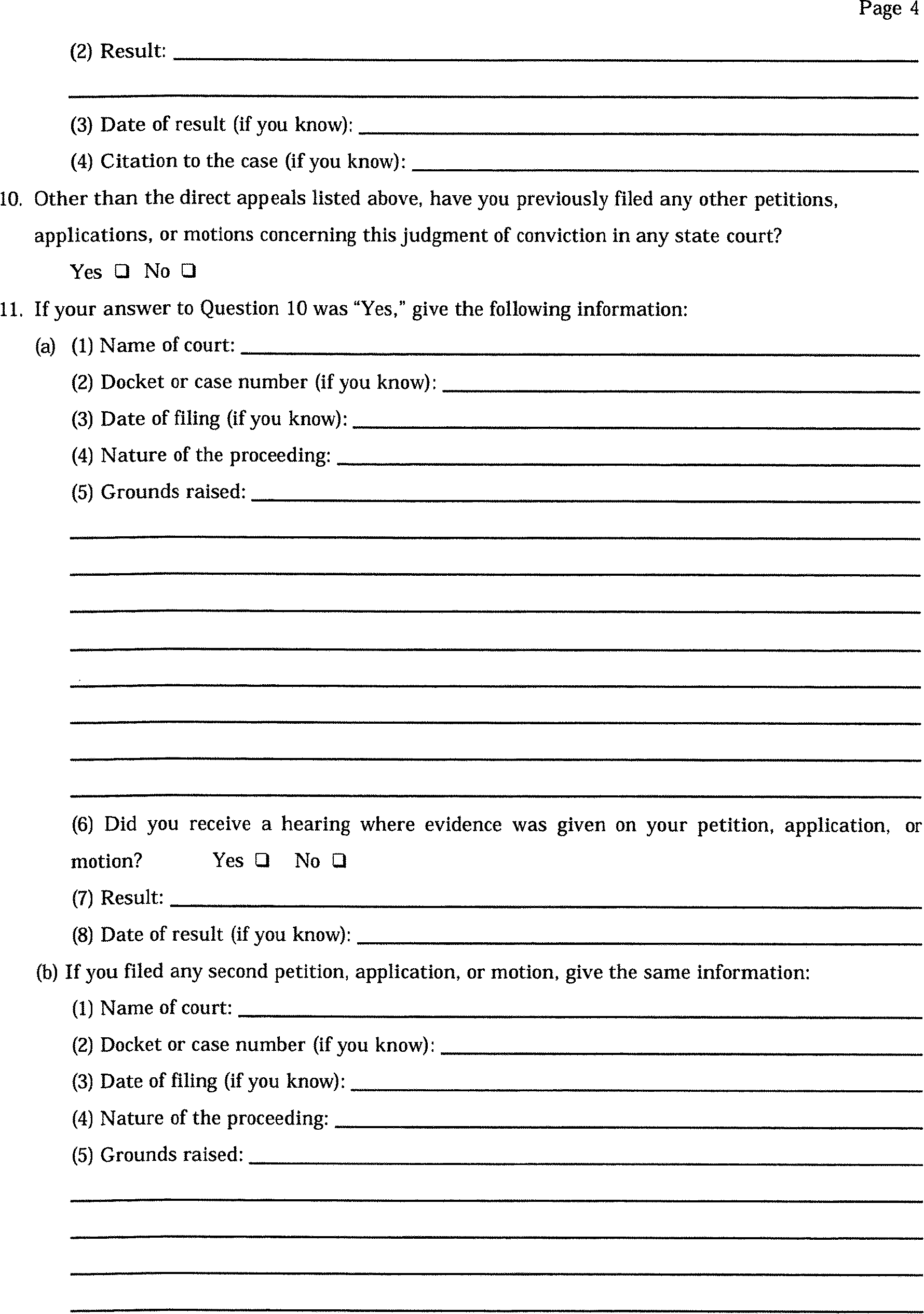

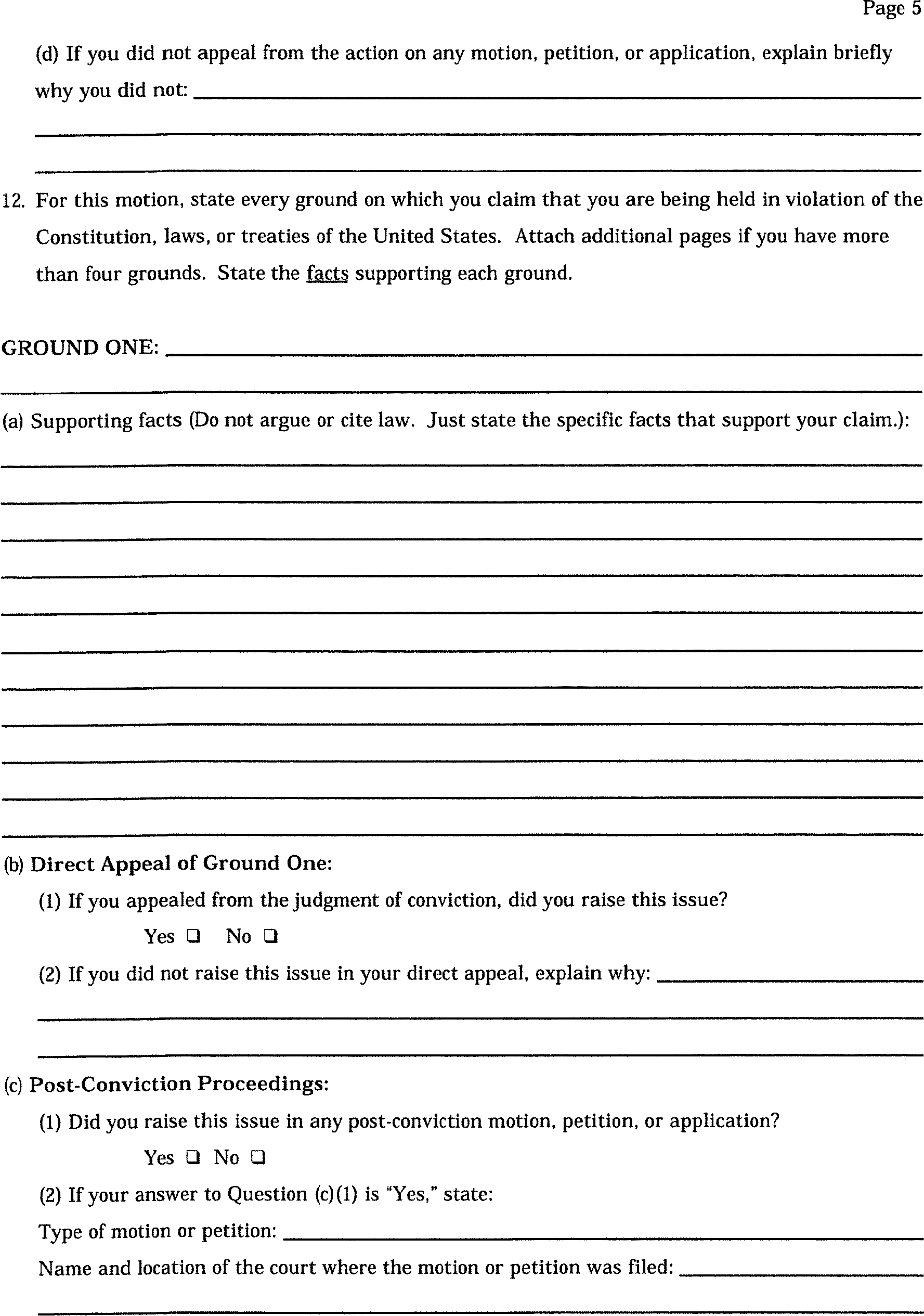

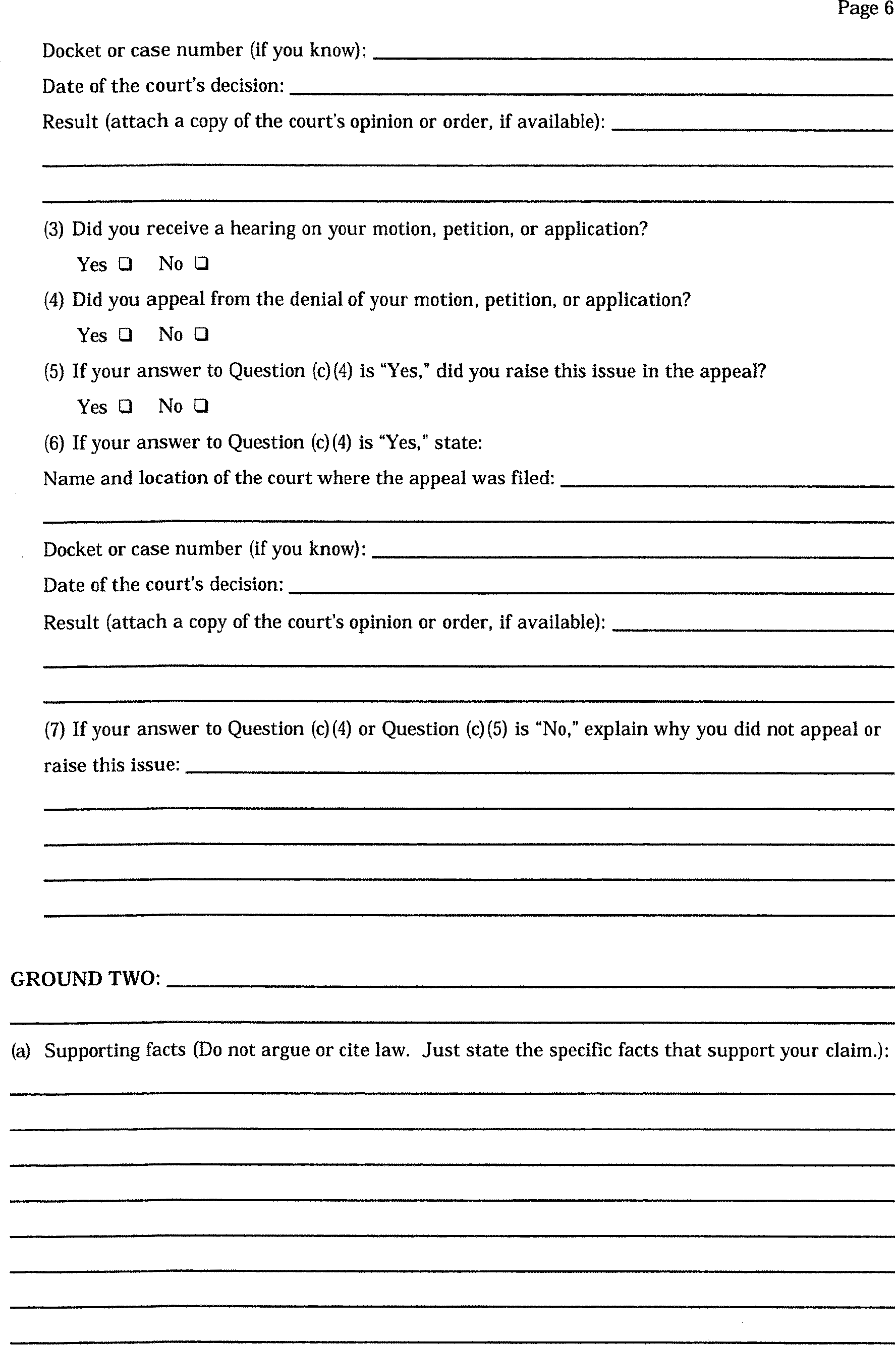

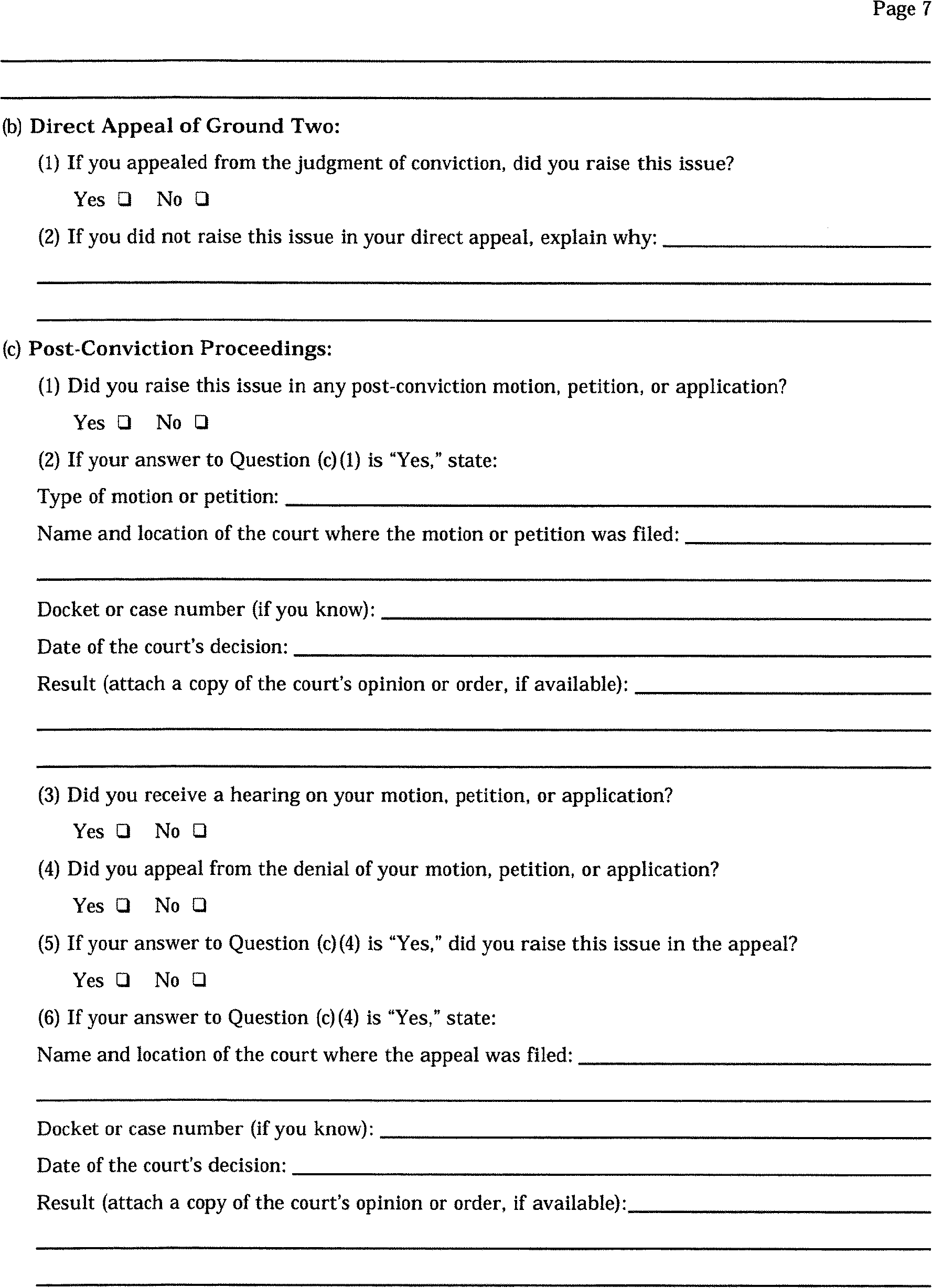

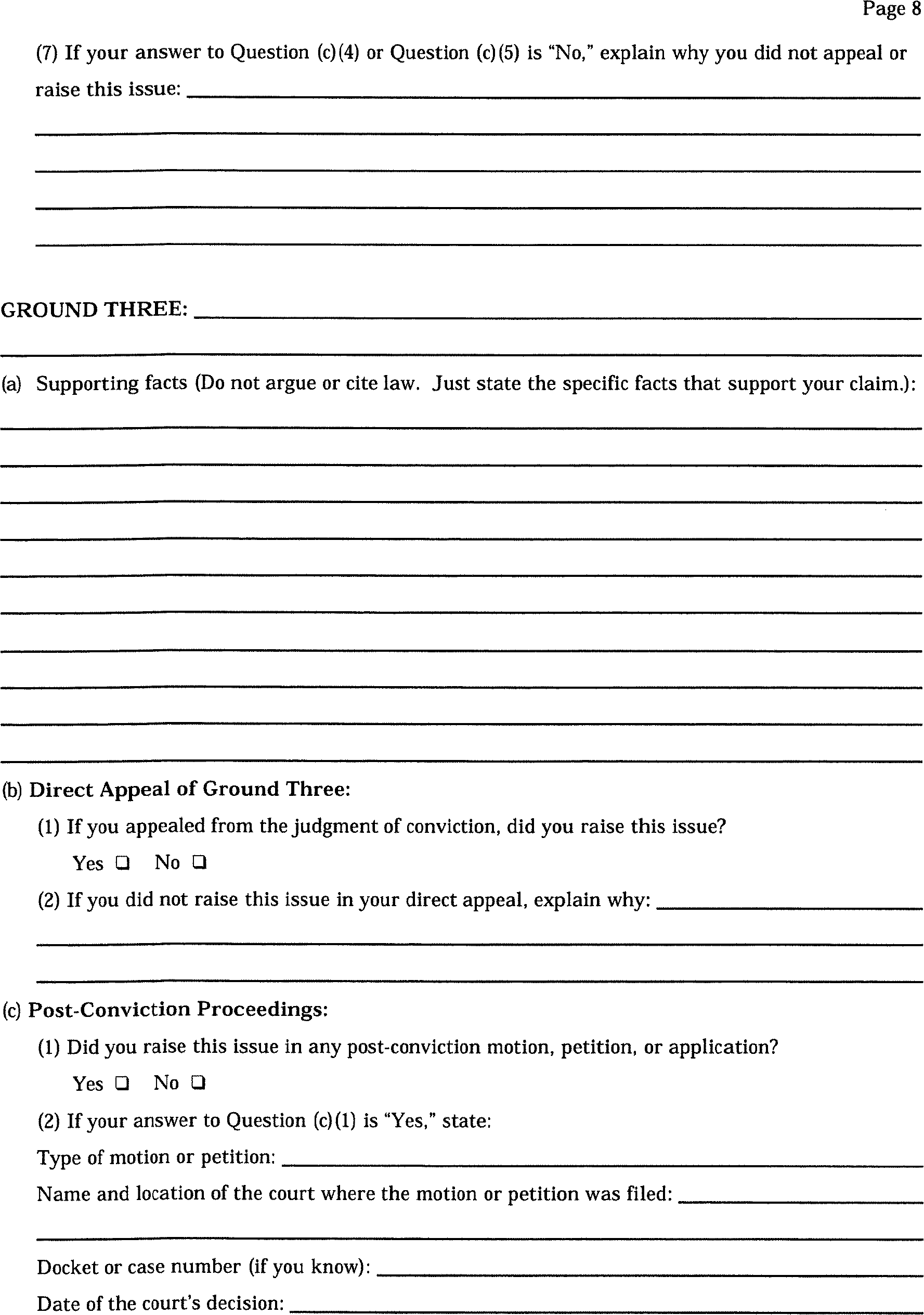

Rule 2. The Petition

(a)

(b)

(c)

(1) specify all the grounds for relief available to the petitioner;

(2) state the facts supporting each ground;

(3) state the relief requested;

(4) be printed, typewritten, or legibly handwritten; and

(5) be signed under penalty of perjury by the petitioner or by a person authorized to sign it for the petitioner under 28 U.S.C. §2242.

(d)

(e)

(As amended

Advisory Committee Note

Rule 2 describes the requirements of the actual petition, including matters relating to its form, contents, scope, and sufficiency. The rule provides more specific guidance for a petitioner and the court than 28 U.S.C. §2242, after which it is patterned.

Subdivision (a) provides that an applicant challenging a state judgment, pursuant to which he is presently in custody, must make his application in the form of a petition for a writ of habeas corpus. It also requires that the state officer having custody of the applicant be named as respondent. This is consistent with 28 U.S.C. §2242, which says in part, "[Application for a writ of habeas corpus] shall allege * * * the name of the person who has custody over [the applicant] * * *." The proper person to be served in the usual case is either the warden of the institution in which the petitioner is incarcerated (Sanders v. Bennett, 148 F.2d 19 (D.C.Cir. 1945)) or the chief officer in charge of state penal institutions.

Subdivision (b) prescribes the procedure to be used for a petition challenging a judgment under which the petitioner will be subject to custody in the future. In this event the relief sought will usually not be released from present custody, but rather for a declaration that the judgment being attacked is invalid. Subdivision (b) thus provides for a prayer for "appropriate relief." It is also provided that the attorney general of the state of the judgment as well as the state officer having actual custody of the petitioner shall be named as respondents. This is appropriate because no one will have custody of the petitioner in the state of the judgment being attacked, and the habeas corpus action will usually be defended by the attorney general. The attorney general is in the best position to inform the court as to who the proper party respondent is. If it is not the attorney general, he can move for a substitution of party.

Since the concept of "custody" requisite to the consideration of a petition for habeas corpus has been enlarged significantly in recent years, it may be worthwhile to spell out the various situations which might arise and who should be named as respondent(s) for each situation.

(1) The applicant is in jail, prison, or other actual physical restraint due to the state action he is attacking. The named respondent shall be the state officer who has official custody of the petitioner (for example, the warden of the prison).

(2) The applicant is on probation or parole due to the state judgment he is attacking. The named respondents shall be the particular probation or parole officer responsible for supervising the applicant, and the official in charge of the parole or probation agency, or the state correctional agency, as appropriate.

(3) The applicant is in custody in any other manner differing from (1) and (2) above due to the effects of the state action he seeks relief from. The named respondent should be the attorney general of the state wherein such action was taken.

(4) The applicant is in jail, prison, or other actual physical restraint but is attacking a state action which will cause him to be kept in custody in the future rather than the government action under which he is presently confined. The named respondents shall be the state or federal officer who has official custody of him at the time the petition is filed and the attorney general of the state whose action subjects the petitioner to future custody.

(5) The applicant is in custody, although not physically restrained, and is attacking a state action which will result in his future custody rather than the government action out of which his present custody arises. The named respondent(s) shall be the attorney general of the state whose action subjects the petitioner to future custody, as well as the government officer who has present official custody of the petitioner if there is such an officer and his identity is ascertainable.

In any of the above situations the judge may require or allow the petitioner to join an additional or different party as a respondent if to do so would serve the ends of justice.

As seen in rule 1 and paragraphs (4) and (5) above, these rules contemplate that a petitioner currently in federal custody will be permitted to apply for habeas relief from a state restraint which is to go into effect in the future. There has been disagreement in the courts as to whether they have jurisdiction of the habeas application under these circumstances (compare Piper v. United States, 306 F.Supp. 1259 (D.Conn. 1969), with United States ex rel. Meadows v. New York, 426 F.2d 1176 (2d Cir. 1970), cert. denied, 401 U.S. 941 (1971)). This rule seeks to make clear that they do have such jurisdiction.

Subdivision (c) provides that unless a district court requires otherwise by local rule, the petition must be in the form annexed to these rules. Having a standard prescribed form has several advantages. In the past, petitions have frequently contained mere conclusions of law, unsupported by any facts. Since it is the relationship of the facts to the claim asserted that is important, these petitions were obviously deficient. In addition, lengthy and often illegible petitions, arranged in no logical order, were submitted to judges who have had to spend hours deciphering them. For example, in Passic v. Michigan, 98 F.Supp. 1015, 1016 (E.D.Mich. 1951), the court dismissed a petition for habeas corpus, describing it as "two thousand pages of irrational, prolix and redundant pleadings * * *."

Administrative convenience, of benefit to both the court and the petitioner, results from the use of a prescribed form. Judge Hubert L. Will briefly described the experience with the use of a standard form in the Northern District of Illinois:

Our own experience, though somewhat limited, has been quite satisfactory. * * *

In addition, [petitions] almost always contain the necessary basic information * * *. Very rarely do we get the kind of hybrid federal-state habeas corpus petition with civil rights allegations thrown in which were not uncommon in the past. * * * [W]hen a real constitutional issue is raised it is quickly apparent * * *.

33 F.R.D. 363, 384

Approximately 65 to 70% of all districts have adopted forms or local rules which require answers to essentially the same questions as contained in the standard form annexed to these rules. All courts using forms have indicated the petitions are time-saving and more legible. The form is particularly helpful in getting information about whether there has been an exhaustion of state remedies or, at least, where that information can be obtained.

The requirement of a standard form benefits the petitioner as well. His assertions are more readily apparent, and a meritorious claim is more likely to be properly raised and supported. The inclusion in the form of the ten most frequently raised grounds in habeas corpus petitions is intended to encourage the applicant to raise all his asserted grounds in one petition. It may better enable him to recognize if an issue he seeks to raise is cognizable under habeas corpus and hopefully inform him of those issues as to which he must first exhaust his state remedies.

Some commentators have suggested that the use of forms is of little help because the questions usually are too general, amounting to little more than a restatement of the statute. They contend the blanks permit a prisoner to fill in the same ambiguous answers he would have offered without the aid of a form. See Comment, Developments in the Law—Federal Habeas Corpus, 83 Harv.L.Rev. 1038, 1177–1178 (1970). Certainly, as long as the statute requires factual pleading, the adequacy of a petition will continue to be affected largely by the petitioner's intelligence and the legal advice available to him. On balance, however, the use of forms has contributed enough to warrant mandating their use.

Giving the petitioner a list of often-raised grounds may, it is said, encourage perjury. See Comment, Developments in the Law—Federal Habeas Corpus, 83 Harv.L.Rev. 1038, 1178 (1970). Most inmates are aware of, or have access to, some common constitutional grounds for relief. Thus, the risk of perjury is not likely to be substantially increased and the benefit of the list for some inmates seems sufficient to outweigh any slight risk that perjury will increase. There is a penalty for perjury, and this would seem the most appropriate way to try to discourage it.

Legal assistance is increasingly available to inmates either through paraprofessional programs involving law students or special programs staffed by members of the bar. See Jacob and Sharma, Justice After Trial: Prisoners' Need for Legal Services in the Criminal-Correctional Process, 18 Kan.L.Rev. 493 (1970). In these situations, the prescribed form can be filled out more competently, and it does serve to ensure a degree of uniformity in the manner in which habeas corpus claims are presented.

Subdivision (c) directs the clerk of the district court to make available to applicants upon request, without charge, blank petitions in the prescribed form.

Subdivision (c) also requires that all available grounds for relief be presented in the petition, including those grounds of which, by the exercise of reasonable diligence, the petitioner should be aware. This is reinforced by rule 9(b), which allows dismissal of a second petition which fails to allege new grounds or, if new grounds are alleged, the judge finds an inexcusable failure to assert the ground in the prior petition.

Both subdivision (c) and the annexed form require a legibly handwritten or typewritten petition. As required by 28 U.S.C. §2242, the petition must be signed and sworn to by the petitioner (or someone acting in his behalf).

Subdivision (d) provides that a single petition may assert a claim only against the judgment or judgments of a single state court (i.e., a court of the same county or judicial district or circuit). This permits, but does not require, an attack in a single petition on judgments based upon separate indictments or on separate counts even though sentences were imposed on separate days by the same court. A claim against a judgment of a court of a different political subdivision must be raised by means of a separate petition.

Subdivision (e) allows the clerk to return an insufficient petition to the petitioner, and it must be returned if the clerk is so directed by a judge of the court. Any failure to comply with the requirements of rule 2 or 3 is grounds for insufficiency. In situations where there may be arguable noncompliance with another rule, such as rule 9, the judge, not the clerk, must make the decision. If the petition is returned it must be accompanied by a statement of the reason for its return. No petitioner should be left to speculate as to why or in what manner his petition failed to conform to these rules.

Subdivision (e) also provides that the clerk shall retain one copy of the insufficient petition. If the prisoner files another petition, the clerk will be in a better position to determine the sufficiency of the new petition. If the new petition is insufficient, comparison with the prior petition may indicate whether the prisoner has failed to understand the clerk's prior explanation for its insufficiency, so that the clerk can make another, hopefully successful, attempt at transmitting this information to the petitioner. If the petitioner insists that the original petition was in compliance with the rules, a copy of the original petition is available for the consideration of the judge. It is probably better practice to make a photocopy of a petition which can be corrected by the petitioner, thus saving the petitioner the task of completing an additional copy.

1982 Amendment

Subdivision (c). The amendment takes into account 28 U.S.C. §1746, enacted after adoption of the §2254 rules. Section 1746 provides that in lieu of an affidavit an unsworn statement may be given under penalty of perjury in substantially the following form if executed within the United States, its territories, possessions or commonwealths: "I declare (or certify, verify, or state) under penalty of perjury that the foregoing is true and correct. Executed on (date). (Signature)." The statute is "intended to encompass prisoner litigation," and the statutory alternative is especially appropriate in such cases because a notary might not be readily available. Carter v. Clark, 616 F.2d 228 (5th Cir. 1980). The §2254 forms have been revised accordingly.

Committee Notes on Rules—2004 Amendment

The language of Rule 2 has been amended as part of general restyling of the rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic and no substantive change is intended, except as described below.

Revised Rule 2(c)(5) has been amended by removing the requirement that the petition be signed personally by the petitioner. As reflected in 28 U.S.C. §2242, an application for habeas corpus relief may be filed by the person who is seeking relief, or by someone acting on behalf of that person. See, e.g., Whitmore v. Arkansas, 495 U.S. 149 (1990) (discussion of requisites for "next friend" standing in petition for habeas corpus). Thus, under the, [sic] amended rule the petition may be signed by petitioner personally or by someone acting on behalf of the petitioner, assuming that the person is authorized to do so, for example, an attorney for the petitioner. The Committee envisions that the courts will apply third-party, or "next-friend," standing analysis in deciding whether the signer was actually authorized to sign the petition on behalf of the petitioner.

The language in new Rule 2(d) has been changed to reflect that a petitioner must substantially follow the standard form, which is appended to the rules, or a form provided by the court. The current rule, Rule 2(c), seems to indicate a preference for the standard "national" form. Under the amended rule, there is no stated preference. The Committee understood that current practice in some courts is that if the petitioner first files a petition using the national form, the courts may then ask the petitioner to supplement it with the local form.

Current Rule 2(e), which provided for returning an insufficient petition, has been deleted. The Committee believed that the approach in Federal Rule of Civil Procedure 5(e) was more appropriate for dealing with petitions that do not conform to the form requirements of the rule. That Rule provides that the clerk may not refuse to accept a filing solely for the reason that it fails to comply with these rules or local rules. Before the adoption of a one-year statute of limitations in the Antiterrorism and Effective Death Penalty Act of 1996,

Changes Made After Publication and Comments. The Committee changed Rule 2(c)(2) to read "state the facts" rather then [sic] "briefly summarize the facts." As one commentator noted, the current language may actually mislead the petitioner and is also redundant. The Committee modified Rule 2(c)(5) to emphasize that any person, other than the petitioner, who signs the petition must be authorized to do so; the revised rule now specifically cites §2242. The Note was changed to reflect that point.

Rule 2(c)(4) was modified to account for those cases where the petitioner prints the petition on a computer word-processing program.

Amendments by Public Law

1976—Subd. (c).

Subd. (e).

Rule 3. Filing the Petition; Inmate Filing

(a)

(1) the applicable filing fee, or

(2) a motion for leave to proceed in forma pauperis, the affidavit required by 28 U.S.C. §1915, and a certificate from the warden or other appropriate officer of the place of confinement showing the amount of money or securities that the petitioner has in any account in the institution.

(b)

(c)

(d)

(As amended Apr. 26, 2004, eff. Dec. 1, 2004.)

Advisory Committee Note

Rule 3 sets out the procedures to be followed by the petitioner and the court in filing the petition. Some of its provisions are currently dealt with by local rule or practice, while others are innovations. Subdivision (a) specifies the petitioner's responsibilities. It requires that the petition, which must be accompanied by two conformed copies thereof, be filed in the office of the clerk of the district court. The petition must be accompanied by the filing fee prescribed by law (presently $5; see 28 U.S.C. §1914(a)), unless leave to prosecute the petition in forma pauperis is applied for and granted. In the event the petitioner desires to prosecute the petition in forma pauperis, he must file the affidavit required by 28 U.S.C. §1915, together with a certificate showing the amount of funds in his institutional account.

Requiring that the petition be filed in the office of the clerk of the district court provides an efficient and uniform system of filing habeas corpus petitions.

Subdivision (b) requires the clerk to file the petition. If the filing fee accompanies the petition, it may be filed immediately, and, if not, it is contemplated that prompt attention will be given to the request to proceed in forma pauperis. The court may delegate the issuance of the order to the clerk in those cases in which it is clear from the petition that there is full compliance with the requirements to proceed in forma pauperis.

Requiring the copies of the petition to be filed with the clerk will have an impact not only upon administrative matters, but upon more basic problems as well. In districts with more than one judge, a petitioner under present circumstances may send a petition to more than one judge. If no central filing system exists for each district, two judges may independently take different action on the same petition. Even if the action taken is consistent, there may be needless duplication of effort.

The requirement of an additional two copies of the form of the petition is a current practice in many courts. An efficient filing system requires one copy for use by the court (central file), one for the respondent (under 3(b), the respondent receives a copy of the petition whether an answer is required or not), and one for petitioner's counsel, if appointed. Since rule 2 provides that blank copies of the petition in the prescribed form are to be furnished to the applicant free of charge, there should be no undue burden created by this requirement.

Attached to copies of the petition supplied in accordance with rule 2 is an affidavit form for the use of petitioners desiring to proceed in forma pauperis. The form requires information concerning the petitioner's financial resources.

In forma pauperis cases, the petition must also be accompanied by a certificate indicating the amount of funds in the petitioner's institution account. Usually the certificate will be from the warden. If the petitioner is on probation or parole, the court might want to require a certificate from the supervising officer. Petitions by persons on probation or parole are not numerous enough, however, to justify making special provision for this situation in the text of the rule.

The certificate will verify the amount of funds credited to the petitioner in an institution account. The district court may by local rule require that any amount credited to the petitioner, in excess of a stated maximum, must be used for the payment of the filing fee. Since prosecuting an action in forma pauperis is a privilege (see Smart v. Heinze, 347 F.2d 114, 116 (9th Cir. 1965)), it is not to be granted when the petitioner has sufficient resources.

Subdivision (b) details the clerk's duties with regard to filing the petition. If the petition does not appear on its face to comply with the requirements of rules 2 and 3, it may be returned in accordance with rule 2(e). If it appears to comply, it must be filed and entered on the docket in the clerk's office. However, under this subdivision the respondent is not required to answer or otherwise move with respect to the petition unless so ordered by the court.

Committee Notes on Rules—2004 Amendment

The language of Rule 3 has been amended as part of general restyling of the rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic and no substantive change is intended except as described below.

The last sentence of current Rule 3(b), dealing with an answer being filed by the respondent, has been moved to revised Rule 5(a).

Revised Rule 3(b) is new and is intended to parallel Federal Rule of Civil Procedure 5(e), which provides that the clerk may not refuse to accept a filing solely for the reason that it fails to comply with these rules or local rules. Before the adoption of a one-year statute of limitations in the Antiterrorism and Effective Death Penalty Act of 1996,

Revised Rule 3(c), which sets out a specific reference to 28 U.S.C. §2244(d), is new and has been added to put petitioners on notice that a one-year statute of limitations applies to petitions filed under these Rules. Although the rule does not address the issue, every circuit that has addressed the issue has taken the position that equitable tolling of the statute of limitations is available in appropriate circumstances. See, e.g., Smith v. McGinnis, 208 F.3d 13, 17–18 (2d Cir. 2000); Miller v. New Jersey State Department of Corrections, 145 F.3d 616, 618–19 (3d Cir. 1998); Harris v. Hutchinson, 209 F.3d 325, 330 (4th Cir. 2000). The Supreme Court has not addressed the question directly. See Duncan v. Walker, 533 U.S. 167, 181 (2001) ("We . . . have no occasion to address the question that Justice Stevens raises concerning the availability of equitable tolling.").

Rule 3(d) is new and provides guidance on determining whether a petition from an inmate is considered to have been filed in a timely fashion. The new provision parallels Federal Rule of Appellate Procedure 25(a)(2)(C).

Changes Made After Publication and Comments. The Committee Note was changed to reflect that the clerk must file a petition, even in those instances where the necessary filing fee or in forma pauperis form is not attached. The Note also includes new language concerning the equitable tolling of the statute of limitations.

Rule 4. Preliminary Review; Serving the Petition and Order

The clerk must promptly forward the petition to a judge under the court's assignment procedure, and the judge must promptly examine it. If it plainly appears from the petition and any attached exhibits that the petitioner is not entitled to relief in the district court, the judge must dismiss the petition and direct the clerk to notify the petitioner. If the petition is not dismissed, the judge must order the respondent to file an answer, motion, or other response within a fixed time, or to take other action the judge may order. In every case, the clerk must serve a copy of the petition and any order on the respondent and on the attorney general or other appropriate officer of the state involved.

(As amended Apr. 26, 2004, eff. Dec. 1, 2004.)

Advisory Committee Note

Rule 4 outlines the options available to the court after the petition is properly filed. The petition must be promptly presented to and examined by the judge to whom it is assigned. If it plainly appears from the face of the petition and any exhibits attached thereto that the petitioner is not entitled to relief in the district court, the judge must enter an order summarily dismissing the petition and cause the petitioner to be notified. If summary dismissal is not ordered, the judge must order the respondent to file an answer or to otherwise plead to the petition within a time period to be fixed in the order.

28 U.S.C. §2243 requires that the writ shall be awarded, or an order to show cause issued, "unless it appears from the application that the applicant or person detained is not entitled thereto." Such consideration may properly encompass any exhibits attached to the petition, including, but not limited to, transcripts, sentencing records, and copies of state court opinions. The judge may order any of these items for his consideration if they are not yet included with the petition. See 28 U.S.C. §753(f) which authorizes payment for transcripts in habeas corpus cases.

It has been suggested that an answer should be required in every habeas proceeding, taking into account the usual petitioner's lack of legal expertise and the important functions served by the return. See Developments in the Law—Federal Habeas Corpus, 83 Harv.L.Rev. 1038, 1178 (1970). However, under §2243 it is the duty of the court to screen out frivolous applications and eliminate the burden that would be placed on the respondent by ordering an unnecessary answer. Allen v. Perini, 424 F.2d 134, 141 (6th Cir. 1970). In addition, "notice" pleading is not sufficient, for the petition is expected to state facts that point to a "real possibility of constitutional error." See Aubut v. State of Maine, 431 F.2d 688, 689 (1st Cir. 1970).

In the event an answer is ordered under rule 4, the court is accorded greater flexibility than under §2243 in determining within what time period an answer must be made. Under §2243, the respondent must make a return within three days after being so ordered, with additional time of up to forty days allowed under the Federal Rules of Civil Procedure, Rule 81(a)(2), for good cause. In view of the widespread state of work overload in prosecutors' offices (see, e.g., Allen, 424 F.2d at 141), additional time is granted in some jurisdictions as a matter of course. Rule 4, which contains no fixed time requirement, gives the court the discretion to take into account various factors such as the respondent's workload and the availability of transcripts before determining a time within which an answer must be made.

Rule 4 authorizes the judge to "take such other action as the judge deems appropriate." This is designed to afford the judge flexibility in a case where either dismissal or an order to answer may be inappropriate. For example, the judge may want to authorize the respondent to make a motion to dismiss based upon information furnished by respondent, which may show that petitioner's claims have already been decided on the merits in a federal court; that petitioner has failed to exhaust state remedies; that the petitioner is not in custody within the meaning of 28 U.S.C. §2254; or that a decision in the matter is pending in state court. In these situations, a dismissal may be called for on procedural grounds, which may avoid burdening the respondent with the necessity of filing an answer on the substantive merits of the petition. In other situations, the judge may want to consider a motion from respondent to make the petition more certain. Or the judge may want to dismiss some allegations in the petition, requiring the respondent to answer only those claims which appear to have some arguable merit.

Rule 4 requires that a copy of the petition and any order be served by certified mail on the respondent and the attorney general of the state involved. See 28 U.S.C. §2252. Presently, the respondent often does not receive a copy of the petition unless the court directs an answer under 28 U.S.C. §2243. Although the attorney general is served, he is not required to answer if it is more appropriate for some other agency to do so. Although the rule does not specifically so provide, it is assumed that copies of the court orders to respondent will be mailed to petitioner by the court.

Committee Notes on Rules—2004 Amendment

The language of Rule 4 has been amended as part of general restyling of the rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic and no substantive change is intended, except as described below.

The amended rule reflects that the response to a habeas petition may be a motion.

The requirement that in every case the clerk must serve a copy of the petition on the respondent by certified mail has been deleted. In addition, the current requirement that the petition be sent to the Attorney General of the state has been modified to reflect practice in some jurisdictions that the appropriate state official may be someone other than the Attorney General, for example, the officer in charge of a local confinement facility. This comports with a similar provision in 28 U.S.C. §2252, which addresses notice of habeas corpus proceedings to the state's attorney general or other appropriate officer of the state.

Changes Made After Publication and Comments. The Rule was modified slightly to reflect the view of some commentators that it is common practice in some districts for the government to file a pre-answer motion to dismiss. The Committee agreed with that recommendation and changed the word "pleading" in the rule to "response." It also made several minor changes to the Committee Note.

Rule 5. The Answer and the Reply

(a)

(b)

(c)

(d)

(1) any brief that the petitioner submitted in an appellate court contesting the conviction or sentence, or contesting an adverse judgment or order in a post-conviction proceeding;

(2) any brief that the prosecution submitted in an appellate court relating to the conviction or sentence; and

(3) the opinions and dispositive orders of the appellate court relating to the conviction or the sentence.

(e)

(As amended Apr. 26, 2004, eff. Dec. 1, 2004; Apr. 25, 2019, eff. Dec. 1, 2019.)

Advisory Committee Note

Rule 5 details the contents of the "answer". (This is a change in terminology from "return," which is still used below when referring to prior practice.) The answer plays an obviously important rule in a habeas proceeding:

The return serves several important functions: it permits the court and the parties to uncover quickly the disputed issues; it may reveal to the petitioner's attorney grounds for release that the petitioner did not know; and it may demonstrate that the petitioner's claim is wholly without merit.

Developments in the Law—Federal Habeas Corpus, 83 Harv.L.Rev. 1083, 1178 (1970).

The answer must respond to the allegations of the petition. While some districts require this by local rule (see, e.g., E.D.N.C.R. 17(B)), under 28 U.S.C. §2243 little specificity is demanded. As a result, courts occasionally receive answers which contain only a statement certifying the true cause of detention, or a series of delaying motions such as motions to dismiss. The requirement of the proposed rule that the "answer shall respond to the allegations of the petition" is intended to ensure that a responsive pleading will be filed and thus the functions of the answer fully served.

The answer must also state whether the petitioner has exhausted his state remedies. This is a prerequisite to eligibility for the writ under 28 U.S.C. §2254(b) and applies to every ground the petitioner raises. Most form petitions now in use contain questions requiring information relevant to whether the petitioner has exhausted his remedies. However, the exhaustion requirement is often not understood by the unrepresented petitioner. The attorney general has both the legal expertise and access to the record and thus is in a much better position to inform the court on the matter of exhaustion of state remedies. An alleged failure to exhaust state remedies as to any ground in the petition may be raised by a motion by the attorney general, thus avoiding the necessity of a formal answer as to that ground.

The rule requires the answer to indicate what transcripts are available, when they can be furnished, and also what proceedings have been recorded and not transcribed. This will serve to inform the court and petitioner as to what factual allegations can be checked against the actual transcripts. The transcripts include pretrial transcripts relating, for example, to pretrial motions to suppress; transcripts of the trial or guilty plea proceeding; and transcripts of any post-conviction proceedings which may have taken place. The respondent is required to furnish those portions of the transcripts which he believes relevant. The court may order the furnishing of additional portions of the transcripts upon the request of petitioner or upon the court's own motion.

Where transcripts are unavailable, the rule provides that a narrative summary of the evidence may be submitted.

Rule 5 (and the general procedure set up by this entire set of rules) does not contemplate a traverse to the answer, except under special circumstances. See advisory committee note to rule 9. Therefore, the old common law assumption of verity of the allegations of a return until impeached, as codified in 28 U.S.C. §2248, is no longer applicable. The meaning of the section, with its exception to the assumption "to the extent that the judge finds from the evidence that they (the allegations) are not true," has given attorneys and courts a great deal of difficulty. It seems that when the petition and return pose an issue of fact, no traverse is required; Stewart v. Overholser, 186 F.2d 339 (D.C. Cir. 1950).

We read §2248 of the Judicial Code as not requiring a traverse when a factual issue has been clearly framed by the petition and the return or answer. This section provides that the allegations of a return or answer to an order to show cause shall be accepted as true if not traversed, except to the extent the judge finds from the evidence that they are not true. This contemplates that where the petition and return or answer do present an issue of fact material to the legality of detention, evidence is required to resolve that issue despite the absence of a traverse. This reference to evidence assumes a hearing on issues raised by the allegations of the petition and the return or answer to the order to show cause.

186 F.2d at 342, n. 5

In actual practice, the traverse tends to be a mere pro forma refutation of the return, serving little if any expository function. In the interests of a more streamlined and manageable habeas corpus procedure, it is not required except in those instances where it will serve a truly useful purpose. Also, under rule 11 the court is given the discretion to incorporate Federal Rules of Civil Procedure when appropriate, so civil rule 15(a) may be used to allow the petitioner to amend his petition when the court feels this is called for by the contents of the answer.

Rule 5 does not indicate who the answer is to be served upon, but it necessarily implies that it will be mailed to the petitioner (or to his attorney if he has one). The number of copies of the answer required is left to the court's discretion. Although the rule requires only a copy of petitioner's brief on appeal, respondent is free also to file a copy of respondent's brief. In practice, courts have found it helpful to have a copy of respondent's brief.

Committee Notes on Rules—2004 Amendment

The language of Rule 5 has been amended as part of general restyling of the rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic and no substantive change is intended, except as described below.