TITLE 11—APPENDIX

FEDERAL RULES OF BANKRUPTCY PROCEDURE

(Effective August 1, 1983, as amended to December 1, 2024)

Historical Note

The Federal Rules of Bankruptcy Procedure were adopted by order of the Supreme Court on Apr. 25, 1983, transmitted to Congress by the Chief Justice on the same day, and became effective Aug. 1, 1983.

The Rules have been amended Aug. 30, 1983, Pub. L. 98–91, §2(a), 97 Stat. 607, eff. Aug. 1, 1983; July 10, 1984, Pub. L. 98–353, title III, §321, 98 Stat. 357; Apr. 29, 1985, eff. Aug. 1, 1985; Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 25, 1989, eff. Aug. 1, 1989; Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 22, 1993, eff. Aug. 1, 1993; Apr. 29, 1994, eff. Aug. 1, 1994; Oct. 22, 1994, Pub. L. 103–394, title I, §114, 108 Stat. 4118; Apr. 27, 1995, eff. Dec. 1, 1995; Apr. 23, 1996, eff. Dec. 1, 1996; Apr. 11, 1997, eff. Dec. 1, 1997; Apr. 26, 1999, eff. Dec. 1, 1999; Apr. 17, 2000, eff. Dec. 1, 2000; Apr. 23, 2001, eff. Dec. 1, 2001; Apr. 29, 2002, eff. Dec. 1, 2002; Mar. 27, 2003, eff. Dec. 1, 2003; Apr. 26, 2004, eff. Dec. 1, 2004; Apr. 25, 2005, eff. Dec. 1, 2005; Apr. 12, 2006, eff. Dec. 1, 2006; Apr. 30, 2007, eff. Dec. 1, 2007; Apr. 23, 2008, eff. Dec. 1, 2008; Mar. 26, 2009, eff. Dec. 1, 2009; Apr. 28, 2010, eff. Dec. 1, 2010; Apr. 26, 2011, eff. Dec. 1, 2011; Apr. 23, 2012, eff. Dec. 1, 2012; Apr. 16, 2013, eff. Dec. 1, 2013; Apr. 25, 2014, eff. Dec. 1, 2014; Apr. 29, 2015, eff. Dec. 1, 2015; Apr. 28, 2016, eff. Dec. 1, 2016; Apr. 27, 2017, eff. Dec. 1, 2017; Apr. 26, 2018, eff. Dec. 1, 2018; Apr. 25, 2019, eff. Dec. 1, 2019; Apr. 27, 2020, eff. Dec. 1, 2020; Apr. 14, 2021, eff. Dec. 1, 2021; Apr. 11, 2022, eff. Dec. 1, 2022; Apr. 24, 2023, eff. Dec. 1, 2023; Apr. 2, 2024, eff. Dec. 1, 2024.

PART I. COMMENCING A BANKRUPTCY CASE; THE PETITION, THE ORDER FOR RELIEF, AND RELATED MATTERS

PART II. OFFICERS AND ADMINISTRATION; NOTICES; MEETINGS; EXAMINATIONS; ELECTIONS AND APPOINTMENTS; FINAL REPORT; COMPENSATION

PART III. CLAIMS; PLANS; DISTRIBUTIONS TO CREDITORS AND EQUITY SECURITY HOLDERS

PART IV. THE DEBTOR'S DUTIES AND BENEFITS

PART V. COURTS AND CLERKS

PART VI. COLLECTING AND LIQUIDATING THE ESTATE

PART VII. ADVERSARY PROCEEDINGS

PART VIII. APPEAL TO A DISTRICT COURT OR A BANKRUPTCY APPELLATE PANEL

PART IX. GENERAL PROVISIONS

PART X. [ABROGATED]

OFFICIAL FORMS [see United States Courts website]

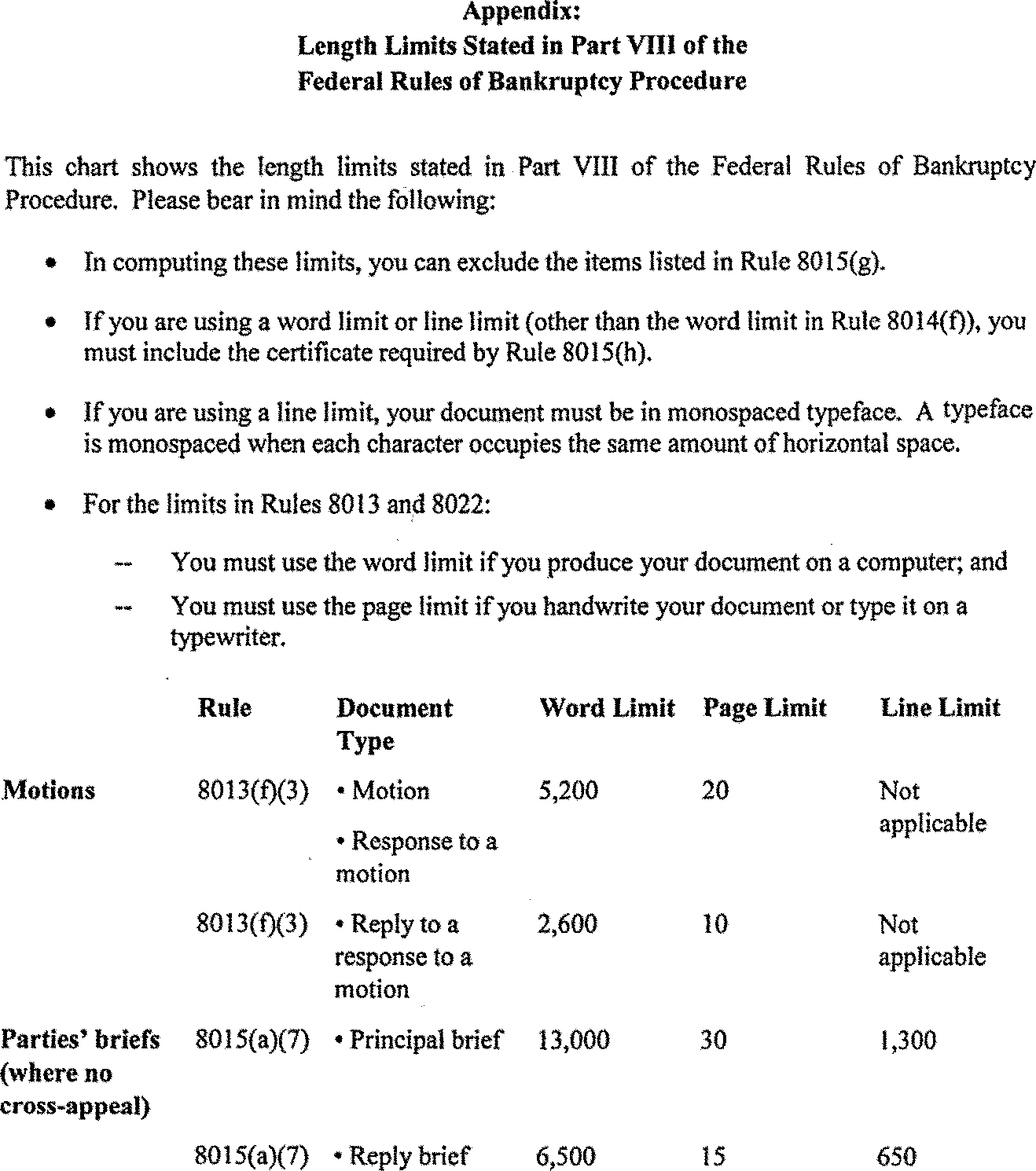

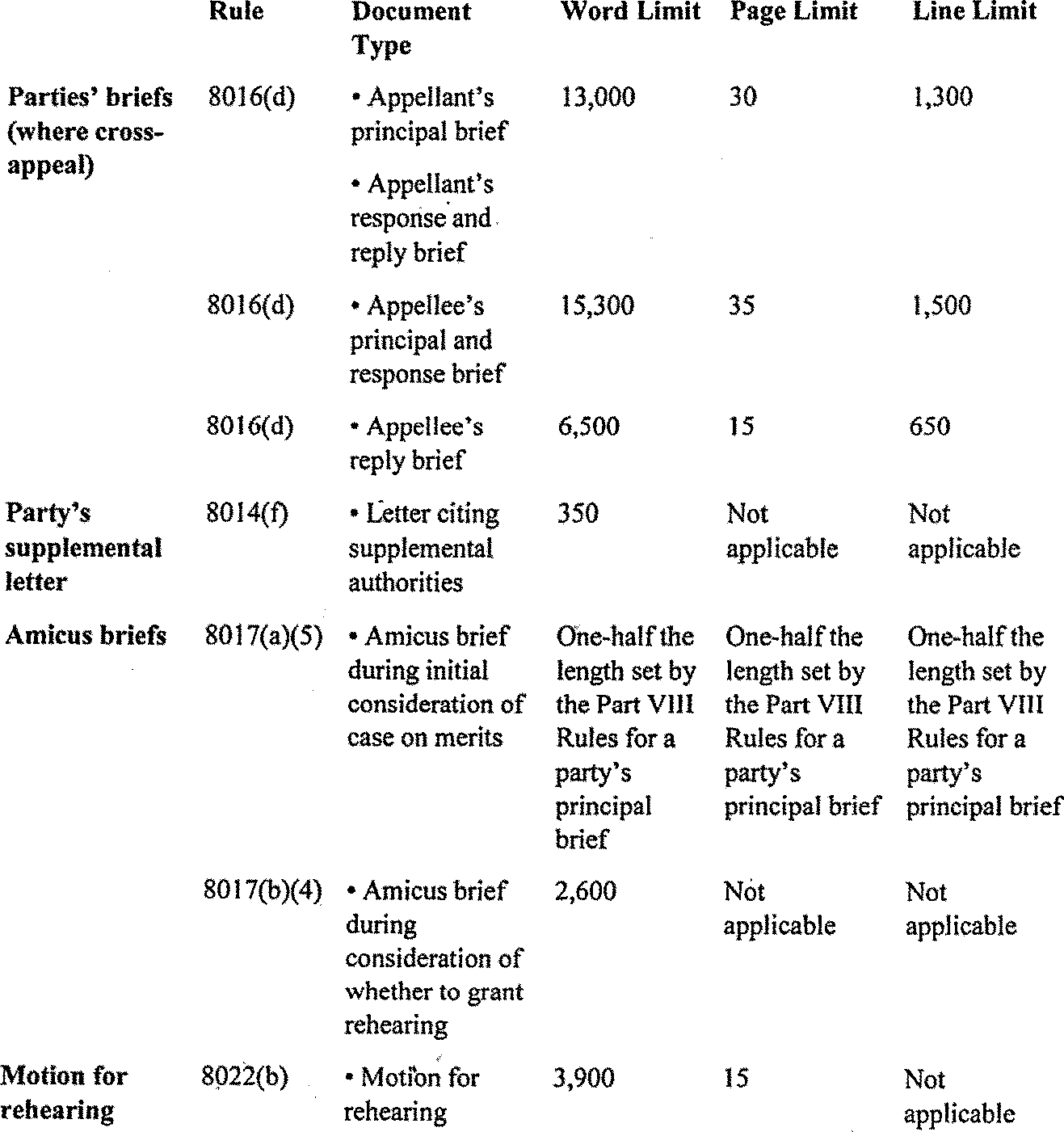

APPENDIX: LENGTH LIMITS STATED IN PART VIII OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE

Effective Date; Application; Supersedure of Prior Rules; Transmission to Congress

Sections 2 to 4 of the Order of the Supreme Court, dated Apr. 25, 1983, provided:

"2. That the aforementioned Bankruptcy Rules shall take effect on August 1, 1983, and shall be applicable to proceedings then pending, except to the extent that in the opinion of the court their application in a pending proceeding would not be feasible or would work injustice, in which event the former procedure applies.

"3. That the Bankruptcy Rules, heretofore prescribed by this Court, be, and they hereby are, superseded by the new rules, effective August 1, 1983.

"4. That the Chief Justice be, and he hereby is, authorized to transmit these new Bankruptcy Rules to the Congress in accordance with the provisions of Section 2075 of Title 28, United States Code."

Rule 1001. Scope; Title; Citations; References to a Specific Form

(a)

(b)

(c)

(d)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 27, 2017, eff. Dec. 1, 2017; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

Section 247 of Public Law 95–598, 92 Stat. 2549 amended 28 U.S.C. §2075 by omitting the last sentence. The effect of the amendment is to require that procedural rules promulgated pursuant to 28 U.S.C. §2075 be consistent with the bankruptcy statute, both titles 11 and 28 U.S.C. Thus, although Rule 1001 sets forth the scope of the bankruptcy rules and forms, any procedural matters contained in title 11 or 28 U.S.C. with respect to cases filed under 11 U.S.C. would control. See 1 Collier, Bankruptcy 3.04 [2][c] (15th ed. 1980).

28 U.S.C. §151 establishes a United States Bankruptcy Court in each district as an adjunct to the district court. This provision does not, however, become effective until April 1, 1984. Public Law 95–598, §402(b). From October 1, 1979 through March 31, 1984, the courts of bankruptcy as defined in §1(10) of the Bankruptcy Act, and created in §2a of that Act continue to be the courts of bankruptcy. Public Law 95–598, §404(a). From their effective date these rules and forms are to be applicable in cases filed under chapters 7, 9, 11 and 13 of title 11 regardless of whether the court is established by the Bankruptcy Act or by 28 U.S.C. §151. Rule 9001 contains a broad and general definition of "bankruptcy court," "court" and "United States Bankruptcy Court" for this purpose.

"Bankruptcy Code" or "Code" as used in these rules means title 11 of the United States Code, the codification of the bankruptcy law. Public Law 95–598, §101. See Rule 9001.

"Bankruptcy Act" as used in the notes to these rules means the Bankruptcy Act of 1898 as amended which was repealed by §401(a) of Public Law 95–598.

These rules apply to all cases filed under the Code except as otherwise specifically stated.

The final sentence of the rule is derived from former Bankruptcy Rule 903. The objective of "expeditious and economical administration" of cases under the Code has frequently been recognized by the courts to be "a chief purpose of the bankruptcy laws." See Katchen v. Landy, 382 U.S. 323, 328 (1966): Bailey v. Glover, 88 U.S. (21 Wall.) 342, 346–47 (1874): Ex parte Christy, 44 U.S. (3 How.) 292, 312–14, 320–22 (1845). The rule also incorporates the wholesome mandate of the last sentence of Rule 1 of the Federal Rules of Civil Procedure. 2 Moore, Federal Practice 1.13 (2d ed. 1980); 4 Wright & Miller, Federal Practice and Procedure-Civil §1029 (1969).

Notes of Advisory Committee on Rules—1987 Amendment

Title I of the Bankruptcy Amendments and Federal Judgeship Act of 1984, Pub. L. No. 98–353, 98 Stat. 333 (hereinafter the 1984 amendments), created a new bankruptcy judicial system in which the role of the district court was substantially increased. 28 U.S.C. §1334 confers on the United States district courts original and exclusive jurisdiction over all cases under title 11 of the United States Code and original but not exclusive jurisdiction over civil proceedings arising under title 11 and civil proceedings arising in or related to a case under title 11.

Pursuant to 28 U.S.C. §157(a) the district court may but need not refer cases and proceedings within the district court's jurisdiction to the bankruptcy judges for the district. Judgments or orders of the bankruptcy judges entered pursuant to 28 U.S.C. §157(b)(1) and (c)(2) are subject to appellate review by the district courts or bankruptcy appellate panels under 28 U.S.C. §158(a).

Rule 81(a)(1) F.R.Civ.P. provides that the civil rules do not apply to proceedings in bankruptcy, except as they may be made applicable by rules promulgated by the Supreme Court, e.g., Part VII of these rules. This amended Bankruptcy Rule 1001 makes the Bankruptcy Rules applicable to cases and proceedings under title 11, whether before the district judges or the bankruptcy judges of the district.

Notes of Advisory Committee on Rules—1991 Amendment

The citation to these rules is amended to conform to the citation form of the Federal Rules of Civil Procedure, Federal Rules of Appellate Procedure, and Federal Rules of Criminal Procedure.

Committee Notes on Rules—2017 Amendment

The last sentence of the rule is amended to incorporate the changes to Rule 1 F.R.Civ.P. made in 1993 and 2015.

The word "administered" is added to recognize the affirmative duty of the court to exercise the authority conferred by these rules to ensure that bankruptcy cases and the proceedings within them are resolved not only fairly, but also without undue cost or delay. As officers of the court, attorneys share this responsibility with the judge to whom the case is assigned.

The addition of the phrase "employed by the court and the parties" emphasizes that parties share in the duty of using the rules to secure the just, speedy, and inexpensive determination of every case and proceeding. Achievement of this goal depends upon cooperative and proportional use of procedure by lawyers and parties.

This amendment does not create a new or independent source of sanctions. Nor does it abridge the scope of any other of these rules.

Committee Notes on Rules—2024 Amendment

The Bankruptcy Rules are the fifth set of national procedural rules to be restyled. The restyled Rules of Appellate Procedure took effect in 1998. The restyled Rules of Criminal Procedure took effect in 2002. The restyled Rules of Civil Procedure took effect in 2007. The restyled Rules of Evidence took effect in 2011. The restyled Bankruptcy Rules apply the same general drafting guidelines and principles used in restyling the Appellate, Criminal, Civil, and Evidence Rules.

General Guidelines. Guidance in drafting, usage, and style was provided by Bryan A. Garner, Guidelines for Drafting and Editing Court Rules, Administrative Office of the United States Courts (1996) and Bryan A. Garner, Dictionary of Modern Legal Usage (2d ed. 1995). See also Joseph Kimble, Guiding Principles for Restyling the Civil Rules, in Preliminary Draft of Proposed Style Revision of the Federal Rules of Civil Procedure, at Mich. Bar J., Sept. 2005, at 56 and Mich. Bar J., Oct. 2005, at 52; Joseph Kimble, Lessons in Drafting from the New Federal Rules of Civil Procedure, 12 Scribes J. Legal Writing 25 (2008–2009).

Formatting Changes. Many of the changes in the restyled Bankruptcy Rules result from using format to achieve clearer presentations. The rules are broken down into constituent parts, using progressively indented subparagraphs with headings and substituting vertical for horizontal lists. "Hanging indents" are used throughout. These formatting changes make the structure of the rules graphic and make the restyled rules easier to read and understand even when the words are not changed.

Changes to Reduce Inconsistent, Ambiguous, Redundant, Repetitive, or Archaic Words. The restyled rules reduce the use of inconsistent terms that say the same thing in different ways. Because different words are presumed to have different meanings, such inconsistencies can result in confusion. The restyled rules reduce inconsistencies by using the same words to express the same meaning. The restyled rules also minimize the use of inherently ambiguous words. The restyled rules minimize the use of redundant "intensifiers." These are expressions that attempt to add emphasis, but instead state the obvious and create negative implications for other rules. The absence of intensifiers in the restyled rules does not change their substantive meaning. The restyled rules also remove words and concepts that are outdated or redundant.

Rule Numbers. The restyled rules keep the same numbers to minimize the effect on research. Subdivisions have been rearranged within some rules to achieve greater clarity and simplicity.

No Substantive Change. The style changes to the rules are intended to make no changes in substantive meaning. The Committee made special efforts to reject any purported style improvement that might result in a substantive change in the application of a rule. The Committee also declined to modify "sacred phrases"—those that have become so familiar in practice that to alter them would be unduly disruptive to practice and expectations. An example in the Bankruptcy Rules would be "meeting of creditors."

Legislative Rules. In those cases in which Congress enacted a rule by statute, in particular Rule 2002(n) (Bankruptcy Amendments and Federal Judgeship Act of 1984, Pub. L. No. 98–353, 98 Stat. 333, 357), Rule 3001(g) (98 Stat. at 361), and Rule 7004(b) and (h) (Bankruptcy Reform Act of 1994, Pub. L. No. 103–394, 108 Stat. 4106, 4118), the Committee has not restyled the rule.

PART I—COMMENCING A BANKRUPTCY CASE; THE PETITION, THE ORDER FOR RELIEF, AND RELATED MATTERS

Rule 1002. Commencing a Bankruptcy Case

(a)

(b)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

Under §§301–303 of the Code, a voluntary or involuntary case is commenced by filing a petition with the bankruptcy court. The voluntary petition may request relief under chapter 7, 9, 11, or 13 whereas an involuntary petition may be filed only under chapter 7 or 11. Section 109 of the Code specifies the types of debtors for whom the different forms of relief are available and §303(a) indicates the persons against whom involuntary petitions may be filed.

The rule in subdivision (a) is in harmony with the Code in that it requires the filing to be with the bankruptcy court.

The number of copies of the petition to be filed is specified in this rule but a local rule may require additional copies. This rule provides for filing sufficient copies for the court's files and for the trustee in a chapter 7 or 13 case.

Official Form No. 1 may be used to seek relief voluntarily under any of the chapters. Only the original need be signed and verified, but the copies must be conformed to the original. See Rules 1008 and 9011(c). As provided in §362(a) of the Code, the filing of a petition acts as a stay of certain acts and proceedings against the debtor, property of the debtor, and property of the estate.

Notes of Advisory Committee on Rules—1987 Amendment

Rules 1002(a), governing a voluntary petition, 1003(a), governing an involuntary petition, and 1003(e), governing a petition in a case ancillary to a foreign proceeding, are combined into this Rule 1002. If a bankruptcy clerk has been appointed for the district, the petition is filed with the bankruptcy clerk. Otherwise, the petition is filed with the clerk of the district court.

The elimination of the reference to the Official Forms of the petition is not intended to change the practice. Rule 9009 provides that the Official Forms "shall be observed and used" in cases and proceedings under the Code.

Subdivision (b) which provided for the distribution of copies of the petition to agencies of the United States has been deleted. Some of these agencies no longer wish to receive copies of the petition, while others not included in subdivision (b) have now requested copies. The Director of the Administrative Office will determine on an ongoing basis which government agencies will be provided a copy of the petition.

The number of copies of a petition that must be filed is a matter for local rule.

Notes of Advisory Committee on Rules—1991 Amendment

Subdivision (b) is derived from Rule X–1002(a). The duties of the United States trustee pursuant to the Code and 28 U.S.C. §586(a) require that the United States trustee be apprised of the commencement of every case under chapters 7, 11, 12 and 13 and this is most easily accomplished by providing that office with a copy of the petition. Although 28 U.S.C. §586(a) does not give the United States trustee an administrative role in chapter 9 cases, §1102 of the Code requires the United States trustee to appoint committees and that section is applicable in chapter 9 cases pursuant to §901(a). It is therefore appropriate that the United States trustee receive a copy of every chapter 9 petition.

Notwithstanding subdivision (b), pursuant to Rule 5005(b)(3), the clerk is not required to transmit a copy of the petition to the United States trustee if the United States trustee requests that it not be transmitted. Many rules require the clerk to transmit a certain document to the United States trustee, but Rule 5005(b)(3) relieves the clerk of that duty under this or any other rule if the United States trustee requests that such document not be transmitted.

Committee Notes on Rules—2024 Amendment

The language of Rule 1002 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1003. Involuntary Petition: Transferred Claims; Joining Other Creditors; Additional Time to Join

(a)

(1) all documents evidencing the transfer, whether it was unconditional, for security, or otherwise; and

(2) a signed statement that:

(A) affirms that the claim was not transferred for the purpose of commencing the case; and

(B) sets forth the consideration for the transfer and its terms.

(b)

(1) the names and addresses of all creditors; and

(2) a brief statement of the nature and amount of each creditor's claim.

(c)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

Subdivision (a). Official Form No. 11 (Involuntary Case: Creditors' Petition), is prescribed for use by petitioning creditors to have a debtor's assets liquidated under chapter 7 of the Code or the business reorganized under chapter 11. It contains the required allegations as specified in §303(b) of the Code. Official Form 12 is prescribed for use by fewer than all the general partners to obtain relief for the partnership as governed by §303(b)(3) of the Code and Rule 1004(b).

Although the number of copies to be filed is specified in Rule 1002, a local rule may require additional copies.

Only the original need be signed and verified, but the copies must be conformed to the original. See Rules 1008 and 9011(c). The petition must be filed with the bankruptcy court. This provision implements §303(b) which provides that an involuntary case is commenced by filing the petition with the court.

As provided in §362 of the Code, the filing of the petition acts as a stay of certain acts and proceedings against the debtor, the debtor's property and property of the estate.

Subdivision (c) retains the explicitness of former Bankruptcy Rule 104(d) that a transfer of a claim for the purpose of commencing a case under the Code is a ground for disqualification of a party to the transfer as a petitioner.

Section 303(b) "is not intended to overrule Bankruptcy Rule 104(d), which places certain restrictions on the transfer of claims for the purpose of commencing an involuntary case." House Report No. 95–595, 95th Cong., 1st Sess. (1977) 322; Senate Report No. 95–989, 95th Cong., 2d Sess. (1978) 33.

The subdivision requires disclosure of any transfer of the petitioner's claim as well as a transfer to the petitioner and applies to transfers for security as well as unconditional transfers, Cf. In re 69th & Crandon Bldg. Corp., 97 F.2d 392, 395 (7th Cir.), cert. denied, 305 U.S. 629 (1938), recognizing the right of a creditor to sign a bankruptcy petition notwithstanding a prior assignment of his claim for the purpose of security. This rule does not, however, qualify the requirement of §303(b)(1) that a petitioning creditor must have a claim not contingent as to liability.

Subdivision (d). Section 303(c) of the Code permits a creditor to join in the petition at any time before the case is dismissed or relief is ordered. While this rule does not require the court to give all creditors notice of the petition, the list of creditors filed by the debtor affords a petitioner the information needed to enable him to give notice for the purpose of obtaining the co-petitioners required to make the petition sufficient. After a reasonable opportunity has been afforded other creditors to join in an involuntary petition, the hearing on the petition should be held without further delay.

Subdivision (e). This subdivision implements §304. A petition for relief under §304 may only be filed by a foreign representative who is defined in §101(20) generally as a representative of an estate in a foreign proceeding. The term "foreign proceeding" is defined in §101(19).

Section 304(b) permits a petition filed thereunder to be contested by a party in interest. Subdivision (e)(2) therefore requires that the summons and petition be served on any person against whom the relief permitted by §304(b) is sought as well as on any other party the court may direct.

The rules applicable to the procedure when an involuntary petition is filed are made applicable generally when a case ancillary to a foreign proceeding is commenced. These rules include Rule 1010 with respect to issuance and service of a summons, Rule 1011 concerning responsive pleadings and motions, and Rule 1018 which makes various rules in Part VII applicable in proceedings on contested petitions.

The venue for a case ancillary to a foreign proceeding is provided in 28 U.S.C. §1474.

Notes of Advisory Committee on Rules—1987 Amendment

The subject matter of subdivisions (a), (b), and (e) has been incorporated in Rules 1002, 1010, 1011, and 1018.

Committee Notes on Rules—2024 Amendment

The language of Rule 1003 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1004. Involuntary Petition Against a Partnership

A petitioner who files an involuntary petition against a partnership under §303(b)(3) must promptly send a copy of the petition to—or serve a copy on—each general partner who is not a petitioner. The clerk must promptly issue a summons for service on any general partner who is not a petitioner. Rule 1010 governs the form and service of the summons.

(As amended Apr. 29, 2002, eff. Dec. 1, 2002; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

This rule is adapted from former Bankruptcy Rule 105 and complements §§301 and 303(b)(3) of the Code.

Subdivision (a) specifies that while all general partners must consent to the filing of a voluntary petition, it is not necessary that they all execute the petition. It may be executed and filed on behalf of the partnership by fewer than all.

Subdivision (b) implements §303(b)(3) of the Code which provides that an involuntary petition may be filed by fewer than all the general partners or, when all the general partners are debtors, by a general partner, trustee of the partner or creditors of the partnership. Rule 1010, which governs service of a petition and summons in an involuntary case, specifies the time and mode of service on the partnership. When a petition is filed against a partnership under §303(b)(3), this rule requires an additional service on the nonfiling general partners. It is the purpose of this subdivision to protect the interests of the nonpetitioning partners and the partnership.

Committee Notes on Rules—2002 Amendment

Section 303(b)(3)(A) of the Code provides that fewer than all of the general partners in a partnership may commence an involuntary case against the partnership. There is no counterpart provision in the Code setting out the manner in which a partnership commences a voluntary case. The Supreme Court has held in the corporate context that applicable nonbankruptcy law determines whether authority exists for a particular debtor to commence a bankruptcy case. See Price v. Gurney, 324 U.S. 100 (1945). The lower courts have followed this rule in the partnership context as well. See, e.g., Jolly v. Pittore, 170 B.R. 793 (S.D.N.Y. 1994); Union Planters National Bank v. Hunters Horn Associates, 158 B.R. 729 (Bankr. M.D. Tenn. 1993); In re Channel 64 Joint Venture, 61 B.R. 255 (Bankr. S.D. Oh. 1986). Rule 1004(a) could be construed as requiring the consent of all of the general partners to the filing of a voluntary petition, even if fewer than all of the general partners would have the authority under applicable nonbankruptcy law to commence a bankruptcy case for the partnership. Since this is a matter of substantive law beyond the scope of these rules, Rule 1004(a) is deleted as is the designation of subdivision (b).

The rule is retitled to reflect that it applies only to involuntary petitions filed against partnerships.

Changes Made After Publication and Comments. No changes since publication.

Committee Notes on Rules—2024 Amendment

The language of Rule 1004 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1004.1. Voluntary Petition on Behalf of an Infant or Incompetent Person

(a)

(b)

(1) a next friend or guardian ad litem may file the petition; and

(2) the court must appoint a guardian ad litem or issue any other order needed to protect the interests of the infant debtor or incompetent debtor.

(Added Apr. 29, 2002, eff. Dec. 1, 2002; amended Apr. 2, 2024, eff. Dec. 1, 2024.)

Committee Notes on Rules—2002

This rule is derived from Rule 17(c) F.R. Civ. P. It does not address the commencement of a case filed on behalf of a missing person. See, e.g., In re King, 234 B.R. 515 (Bankr. D.N.M. 1999)

Changes Made After Publication and Comments. No changes were made.

Committee Notes on Rules—2024 Amendment

The language of Rule 1004.1 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1004.2. Petition in a Chapter 15 Case

(a)

(1) designate the country where the debtor has its center of main interests; and

(2) identify each country in which a foreign proceeding against, by, or regarding the debtor is pending.

(b)

• the debtor;

• all persons or bodies authorized to administer the debtor's foreign proceedings;

• all entities against whom provisional relief is sought under §1519;

• all parties to litigation pending in the United States in which the debtor was a party when the petition was filed; and

• any other entity as the court orders.

(Added Apr. 26, 2011, eff. Dec. 1, 2011; amended Apr. 2, 2024, eff. Dec. 1, 2024.)

Committee Notes on Rules—2011

This rule is new. Subdivision (a) directs any entity that files a petition for recognition of a foreign proceeding under chapter 15 of the Code to state in the petition the center of the debtor's main interests. The petition must also list each country in which a foreign proceeding involving the debtor is pending. This information will assist the court and parties in interest in determining whether the foreign proceeding is a foreign main or nonmain proceeding.

Subdivision (b) sets a deadline of seven days prior to the hearing on the petition for recognition for filing a motion challenging the statement in the petition regarding the country in which the debtor's center of main interests is located.

Changes Made After Publication. The rule was first published for comment in August 2008. After publication, the deadline in subdivision (b) for challenging the designation of the center of the debtor's main interests was changed from "60 days after the notice of the petition has been given" to "no later than seven days before the date set for the hearing on the petition."

The rule as revised was published in August 2009. Minor stylistic changes were made to the rule's language and the Committee Note following that publication.

No comments were submitted on proposed Rule 1004.2 after its republication in August 2009.

Committee Notes on Rules—2024 Amendment

The language of Rule 1004.2 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1005. Caption of a Petition; Title of the Case

(a)

(1) name;

(2) employer-identification number;

(3) the last 4 digits of the social-security number or individual taxpayer-identification number;

(4) any other federal taxpayer-identification number; and

(5) all other names the debtor has used within 8 years before the petition was filed.

(b)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Mar. 27, 2003, eff. Dec. 1, 2003; Apr. 23, 2008, eff. Dec. 1, 2008; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

The title of the case should include all names used by the debtor, such as trade names, former married names and maiden name. See also Official Form No. 1 and the Advisory Committee Note to that Form. Additional names of the debtor are also required to appear in the caption of each notice to creditors. See Rule 2002(m).

Committee Notes on Rules—2003 Amendment

The rule is amended to implement the Judicial Conference policy to limit the disclosure of a party's social security number and similar identifiers. Under the rule, as amended, only the last four digits of the debtor's social security number need be disclosed. Publication of the employer identification number does not present the same identity theft or privacy protection issues. Therefore, the caption must include the full employer identification number.

Debtors must submit with the petition a statement setting out their social security numbers. This enables the clerk to include the full social security number on the notice of the section 341 meeting of creditors, but the statement itself is not submitted in the case or maintained in the case file.

Changes Made After Publication and Comments. The rule was changed only slightly after publication. The rule was changed to make clear that only the debtor's social security number is truncated to the final four digits, but other numerical identifiers must be set out in full. The rule also was amended to include a requirement that a debtor list other federal taxpayer identification numbers that may be in use.

Committee Notes on Rules—2008 Amendment

The rule is amended to require the disclosure of all names used by the debtor in the past eight years. Section 727(a)(8) was amended in 2005 to extend the time between chapter 7 discharges from six to eight years, and the rule is amended to implement that change. The rule also is amended to require the disclosure of the last four digits of an individual debtor's taxpayer-identification number. This truncation of the number applies only to individual debtors. This is consistent with the requirements of Rule 9037.

Changes Made After Publication. No changes were made after publication.

Committee Notes on Rules—2024 Amendment

The language of Rule 1005 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1006. Filing Fee

(a)

(1) the filing fee required by 28 U.S.C. §1930(a)(1)–(5); and

(2) any other fee that the Judicial Conference of the United States requires under 28 U.S.C. §1930(b) to be paid upon filing.

(b)

(1) Application to Pay by Installment. The clerk must accept for filing an individual's voluntary petition, regardless of whether any part of the filing fee is paid, if it is accompanied by a completed and signed application to pay in installments (Form 103A).

(2) Court Decision on Installments. Before the meeting of creditors, the court may order payment of the entire filing fee or may order the debtor to pay it in installments, designating the number of installments (not to exceed 4), the amount of each one, and payment dates. All payments must be made within 120 days after the petition is filed. The court may, for cause, extend the time to pay an installment, but the last one must be paid within 180 days after the petition is filed.

(3) Postponing Other Payments. Until the filing fee has been paid in full, the debtor or Chapter 13 trustee must not make any further payment to an attorney or any other person who provides services to the debtor in connection with the case.

(c)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 23, 1996, eff. Dec. 1, 1996; Apr. 23, 2008, eff. Dec. 1, 2008; Apr. 27, 2017, eff. Dec. 1, 2017; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

28 U.S.C. §1930 specifies the filing fees for petitions under chapters 7, 9, 11 and 13 of the Code. It also permits the payment in installments by individual debtors.

Subdivision (b) is adapted from former Bankruptcy Rule 107. The administrative cost of installments in excess of four is disproportionate to the benefits conferred. Prolonging the period beyond 180 days after the commencement of the case causes undesirable delays in administration. Paragraph (2) accordingly continues the imposition of a maximum of four on the number of installments and retains the maximum period of installment payments allowable on an original application at 120 days. Only in extraordinary cases should it be necessary to give an applicant an extension beyond the four months. The requirement of paragraph (3) that filing fees be paid in full before the debtor may pay an attorney for services in connection with the case codifies the rule declared in In re Latham, 271 Fed. 538 (N.D.N.Y. 1921), and In re Darr, 232 Fed. 415 (N.D. Cal. 1916).

Notes of Advisory Committee on Rules—1987 Amendment

Subdivision (b)(3) is expanded to prohibit payments by the debtor or the chapter 13 trustee not only to attorneys but to any person who renders services to the debtor in connection with the case.

Notes of Advisory Committee on Rules—1996 Amendment

The Judicial Conference prescribes miscellaneous fees pursuant to 28 U.S.C. §1930(b). In 1992, a $30 miscellaneous administrative fee was prescribed for all chapter 7 and chapter 13 cases. The Judicial Conference fee schedule was amended in 1993 to provide that an individual debtor may pay this fee in installments.

Subdivision (a) of this rule is amended to clarify that every petition must be accompanied by any fee prescribed under 28 U.S.C. §1930(b) that is required to be paid when a petition is filed, as well as the filing fee prescribed by 28 U.S.C. §1930(a). By defining "filing fee" to include Judicial Conference fees, the procedures set forth in subdivision (b) for paying the filing fee in installments will also apply with respect to any Judicial Conference fee required to be paid at the commencement of the case.

GAP Report on Rule 1006. No changes since publication, except for a stylistic change in subdivision (a).

Committee Notes on Rules—2008 Amendment

Subdivision (a) is amended to include a reference to new subdivision (c), which deals with fee waivers under 28 U.S.C. §1930(f), which was added in 2005.

Subdivision (b)(1) is amended to delete the sentence requiring a disclosure that the debtor has not paid an attorney or other person in connection with the case. Inability to pay the filing fee in installments is one of the requirements for a fee waiver under the 2005 revisions to 28 U.S.C. §1930(f). If the attorney payment prohibition were retained, payment of an attorney's fee would render many debtors ineligible for installment payments and thus enhance their eligibility for the fee waiver. The deletion of this prohibition from the rule, which was not statutorily required, ensures that debtors who have the financial ability to pay the fee in installments will do so rather than request a waiver.

Subdivision (b)(3) is amended in conformance with the changes to subdivision (b)(1) to reflect the 2005 amendments. The change is meant to clarify that subdivision (b)(3) refers to payments made after the debtor has filed the bankruptcy case and after the debtor has received permission to pay the fee in installments. Otherwise, the subdivision may conflict with the intent and effect of the amendments to subdivision (b)(1).

Changes Made After Publication. No changes were made after publication.

Committee Notes on Rules—2017 Amendment

Subdivision (b)(1) is amended to clarify that an individual debtor's voluntary petition, accompanied by an application to pay the filing fee in installments, must be accepted for filing, even if the court requires the initial installment to be paid at the time the petition is filed and the debtor fails to make that payment. Because the debtor's bankruptcy case is commenced upon the filing of the petition, dismissal of the case due to the debtor's failure to make the initial or a subsequent installment payment is governed by Rule 1017(b)(1).

Committee Notes on Rules—2024 Amendment

The language of Rule 1006 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

1 So in original. Probably should be followed by a comma.

Rule 1007. Lists, Schedules, Statements, and Other Documents; Time to File

(a)

(1) Voluntary Case. In a voluntary case, the debtor must file with the petition a list containing the name and address of each entity included or to be included on Schedules D, E/F, G, and H of the Official Forms. Unless it is a governmental unit, a corporate debtor must:

(A) include a corporate-ownership statement containing the information described in Rule 7007.1; and

(B) promptly file a supplemental statement if changed circumstances make the original statement inaccurate.

(2) Involuntary Case. Within 7 days after the order for relief has been entered in an involuntary case, the debtor must file a list containing the name and address of each entity included or to be included on Schedules D, E/F, G, and H of the Official Forms.

(3) Chapter 11—List of Equity Security Holders. Unless the court orders otherwise, a Chapter 11 debtor must, within 14 days after the order for relief is entered, file a list of the debtor's equity security holders by class. The list must show the number and type of interests registered in each holder's name, along with the holder's last known address or place of business

(4) Chapter 15—Information Required from a Foreign Representative. If a foreign representative files a petition under Chapter 15 for recognition of a foreign proceeding, the representative must—in addition to the documents required by §1515—include with the petition:

(A) a corporate-ownership statement containing the information described in Rule 7007.1; and

(B) unless the court orders otherwise, a list containing the names and addresses of:

(i) all persons or bodies authorized to administer the debtor's foreign proceedings;

(ii) all entities against whom provisional relief is sought under §1519; and

(iii) all parties to litigation pending in the United States in which the debtor was a party when the petition was filed.

(5) Extending the Time to File. On motion and for cause, the court may extend the time to file any list required by this Rule 1007(a). Notice of the motion must be given to:

• the United States trustee;

• any trustee;

• any committee elected under §705 or appointed under §1102; and

• any other party as the court orders.

(b)

(1) In General. Except in a Chapter 9 case or when the court orders otherwise, the debtor must file—prepared as prescribed by the appropriate Official Form, if any—

(A) schedules of assets and liabilities;

(B) a schedule of current income and expenditures;

(C) a schedule of executory contracts and unexpired leases;

(D) a statement of financial affairs;

(E) copies of all payment advices or other evidence of payment that the debtor received from any employer within 60 days before the petition was filed—with all but the last 4 digits of the debtor's social-security number or individual taxpayer-identification number deleted; and

(F) a record of the debtor's interest, if any, in an account or program of the type specified in §521(c).

(2) Statement of Intention. In a Chapter 7 case, an individual debtor must:

(A) file the statement of intention required by §521(a) (Form 108); and

(B) before or upon filing, serve a copy on the trustee and the creditors named in the statement.

(3) Credit-Counseling Statement. Unless the United States trustee has determined that the requirement to file a credit-counseling statement under §109(h) does not apply in the district, an individual debtor must file a statement of compliance (included in Form 101). The debtor must include one of the following:

(A) a certificate and any debt-repayment plan required by §521(b);

(B) a statement that the debtor has received the credit-counseling briefing required by §109(h)(1), but does not have a §521(b) certificate;

(C) a certification under §109(h)(3); or

(D) a request for a court determination under §109(h)(4).

(4) Current Monthly Income—Chapter 7. Unless §707(b)(2)(D) applies, an individual debtor in a Chapter 7 case must:

(A) file a statement of current monthly income (Form 122A–1); and

(B) if that income exceeds the median family income for the debtor's state and household size, file the Chapter 7 means-test calculation (Form 122A–2).

(5) Current Monthly Income—Chapter 11. An individual debtor in a Chapter 11 case (unless under Subchapter V) must file a statement of current monthly income (Form 122B).

(6) Current Monthly Income—Chapter 13. A debtor in a Chapter 13 case must:

(A) file a statement of current monthly income (Form 122C–1); and

(B) if that income exceeds the median family income for the debtor's state and household size, file the Chapter 13 calculation of disposable income (Form 122C-2).

(7) Personal Financial-Management Course. Unless an approved provider has notified the court that the debtor has completed a course in personal financial management after filing the petition or the debtor is not required to complete one as a condition to discharge, an individual debtor in a Chapter 7 or Chapter 13 case—or in a Chapter 11 case in which §1141(d)(3) applies—must file a certificate of course completion issued by the provider.

(8) Limitation on a Homestead Exemption. This Rule 1007(b)(8) applies if an individual debtor in a Chapter 11, 12, or 13 case claims an exemption under §522(b)(3)(A) in property of the type described in §522(p)(1) and the property value exceeds the amount specified in §522(q)(1). The debtor must file a statement about any pending proceeding in which the debtor may be found:

(A) guilty of the type of felony described in §522(q)(1)(A); or

(B) liable for the type of debt described in §522(q)(1)(B).

(c)

(1) Voluntary Case—Various Documents. Unless (d), (e), (f), or (h) provides otherwise, the debtor in a voluntary case must file the documents required by (b)(1), (b)(4), (b)(5), and (b)(6) with the petition or within 14 days after it is filed.

(2) Involuntary Case—Various Documents. In an involuntary case, the debtor must file the documents required by (b)(1) within 14 days after the order for relief is entered.

(3) Credit-Counseling Documents. In a voluntary case, the documents required by (b)(3)(A), (C), or (D) must be filed with the petition. Unless the court orders otherwise, a debtor who has filed a statement under (b)(3)(B) must file the documents required by (b)(3)(A) within 14 days after the order for relief is entered.

(4) Financial-Management Course. Unless the court extends the time to file, an individual debtor must file the certificate required by (b)(7) as follows

(A) in a Chapter 7 case, within 60 days after the first date set for the meeting of creditors under §341; and

(B) in a Chapter 11 or Chapter 13 case, no later than the date the last payment is made under the plan or the date a motion for a discharge is filed under §1141(d)(5)(B) or §1328(b).

(5) Limitation on Homestead Exemption. The debtor must file the statement required by (b)(8) no earlier than the date of the last payment made under the plan or the date a motion for a discharge is filed under §1141(d)(5)(B), 1228(b), or 1328(b).

(6) Documents in a Converted Case. Unless the court orders otherwise, a document filed before a case is converted to another chapter is considered filed in the converted case.

(7) Extending the Time to File. Except as §1116(3) provides otherwise, the court, on motion and for cause, may extend the time to file a document under this rule. The movant must give notice of the motion to:

• the United States trustee;

• any committee elected under §705 or appointed under §1102; and

• any trustee, examiner, and other party as the court orders.

If the motion is granted, notice must be given to the United States trustee and to any committee, trustee, and other party as the court orders.

(d)

(e)

(f)

(g)

(h)

(1) confirming a Chapter 11 plan (other than one confirmed under §1191(b)); or

(2) discharging the debtor in a Chapter 12 case, a Chapter 13 case, or a case under Subchapter V of Chapter 11 in which the plan is confirmed under §1191(b).

(i)

(1) disclose any list of the debtor's security holders in its possession or under its control by:

(A) producing the list or a copy of it;

(B) allowing inspection or copying; or

(C) making any other disclosure; and

(2) indicate the name, address, and security held by each listed holder.

(j)

(k)

(1) that the trustee, a petitioning creditor, a committee, or other party do so within the time set by the court; and

(2) that the cost incurred be reimbursed as an administrative expense.

(l)

(m)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 23, 1996, eff. Dec. 1, 1996; Apr. 23, 2001, eff. Dec. 1, 2001; Mar. 27, 2003, eff. Dec. 1, 2003; Apr. 25, 2005, eff. Dec. 1, 2005; Apr. 23, 2008, eff. Dec. 1, 2008; Mar. 26, 2009, eff. Dec. 1, 2009; Apr. 28, 2010, eff. Dec. 1, 2010; Apr. 23, 2012, eff. Dec. 1, 2012; Apr. 16, 2013, eff. Dec. 1, 2013; Apr. 29, 2015, eff. Dec. 1, 2015; Apr. 11, 2022, eff. Dec. 1, 2022; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

This rule is an adaptation of former Rules 108, 8–106, 10–108 and 11–11. As specified in the rule, it is applicable in all types of cases filed under the Code.

Subdivision (a) requires at least a list of creditors with their names and addresses to be filed with the petition. This list is needed for notice of the meeting of creditors (Rule 2002) and notice of the order for relief (§342 of the Code). The list will also serve to meet the requirements of §521(1) of the Code. Subdivision (a) recognizes that it may be impossible to file the schedules required by §521(1) and subdivision (b) of the rule at the time the petition is filed but in order for the case to proceed expeditiously and efficiently it is necessary that the clerk have the names and addresses of creditors. It should be noted that subdivision (d) of the rule requires a special list of the 20 largest unsecured creditors in chapter 9 and 11 cases. That list is for the purpose of selecting a committee of unsecured creditors.

Subdivision (b) is derived from former Rule 11–11 and conforms with §521. This subdivision indicates the forms to be used. The court may dispense with the filing of schedules and the statement of affairs pursuant to §521.

Subdivisions (c) and (f) specify the time periods for filing the papers required by the rule as well as the number of copies. The provisions dealing with an involuntary case are derived from former Bankruptcy Rule 108. Under the Code, a chapter 11 case may be commenced by an involuntary petition (§303(a)), whereas under the Act, a Chapter XI case could have been commenced only by a voluntary petition. A motion for an extension of time to file the schedules and statements is required to be made on notice to parties, as the court may direct, including a creditors' committee if one has been appointed under §1102 of the Code and a trustee or examiner if one has been appointed pursuant to §1104 of the Code. Although written notice is preferable, it is not required by the rule; in proper circumstances the notice may be by telephone or otherwise.

Subdivision (d) is new and requires that a list of the 20 largest unsecured creditors, excluding insiders as defined in §101(25) of the Code, be filed with the petition. The court, pursuant to §1102 of the Code, is required to appoint a committee of unsecured creditors as soon as practicable after the order for relief. That committee generally is to consist of the seven largest unsecured creditors who are willing to serve. The list should, as indicated on Official Form No. 9, specify the nature and amount of the claim. It is important for the court to be aware of the different types of claims existing in the case and this form should supply such information.

Subdivision (e) applies only in chapter 9 municipality cases. It gives greater discretion to the court to determine the time for filing a list of creditors and any other matter related to the list. A list of creditors must at some point be filed since one is required by §924 of the Code. When the plan affects special assessments, the definitions in §902(2) and (3) for "special tax payer" and "special tax payer affected by the plan" become relevant.

Subdivision (g) is derived from former Rules 108(c) and 11–11. Nondebtor general partners are liable to the partnership's trustee for any deficiency in the partnership's estate to pay creditors in full as provided by §723 of the Code. Subdivision (g) authorizes the court to require a partner to file a statement of personal assets and liabilities to provide the trustee with the relevant information.

Subdivision (h) is derived from former Bankruptcy Rule 108(e) for chapter 7, 11 and 13 purposes. It implements the provisions in and language of §541(a)(5) of the Code.

Subdivisions (i) and (j) are adapted from §§165 and 166 of the Act and former Rule 10–108(b) and (c) without change in substance. The term "party in interest" is not defined in the Code or the rules, but reference may be made to §1109(b) of the Code. In the context of this subdivision, the term would include the debtor, the trustee, any indenture trustee, creditor, equity security holder or committee appointed pursuant to §1102 of the Code.

Subdivision (k) is derived from former Rules 108(d) and 10–108(a).

Notes of Advisory Committee on Rules—1987 Amendment

Subdivisions (b), (c), and (g) are amended to provide for the filing of a schedule of current income and current expenditures and the individual debtor's statement of intention. These documents are required by the 1984 amendments to §521 of the Code. Official Form No. 6A is prescribed for use by an individual debtor for filing a schedule of current income and current expenditures in a chapter 7 or chapter 11 case. Although a partnership or corporation is also required by §521(1) to file a schedule of current income and current expenditures, no Official Form is prescribed therefor.

The time for filing the statement of intention is governed by §521(2)(A). A copy of the statement of intention must be served on the trustee and the creditors named in the statement within the same time. The provisions of subdivision (c) governing the time for filing when a chapter 11 or chapter 13 case is converted to a chapter 7 case have been omitted from subdivision (c) as amended. Filing after conversion is now governed exclusively by Rule 1019.

Subdivision (f) has been abrogated. The number of copies of the documents required by this rule will be determined by local rule.

Subdivision (h) is amended to include a direct reference to §541(a)(5).

Subdivision (k) provides that the court may not order an entity other than the debtor to prepare and file the statement of intention.

Notes of Advisory Committee on Rules—1991 Amendment

References to Official Form numbers and to the Chapter 13 Statement are deleted and subdivision (b) is amended in anticipation of future revision and renumbering of the Official Forms. The debtor in a chapter 12 or chapter 13 case shall file the list, schedules and statements required in subdivisions (a)(1), (b)(1), and (h). It is expected that the information currently provided in the Chapter 13 Statement will be included in the schedules and statements as revised not later than the effective date of these rule amendments.

Subdivisions (a)(4) and (c) are amended to provide the United States trustee with notice of any motion to extend the time for the filing of any lists, schedules, or statements. Such notice enables the United States trustee to take appropriate steps to avoid undue delay in the administration of the case. See 28 U.S.C. §586(a)(3)(G). Subdivisions (a)(4) and (c) are amended further to provide notice to committees elected under §705 or appointed pursuant to §1102 of the Code. Committees of retired employees appointed pursuant to §1114 are not included.

The additions of references to unexpired leases in subdivisions (b)(1) and (g) indicate that the schedule requires the inclusion of unexpired leases as well as other executory contracts.

The words "with the court" in subdivisions (b)(1), (e), and (g) are deleted as unnecessary. See Rules 5005(a) and 9001(3).

Subdivision (l), which is derived from Rule X–1002(a), provides the United States trustee with the information required to perform certain administrative duties such as the appointment of a committee of unsecured creditors. In a chapter 7 case, the United States trustee should be aware of the debtor's intention with respect to collateral that secures a consumer debt so that the United States trustee may monitor the progress of the case. Pursuant to §307 of the Code, the United States trustee has standing to raise, appear and be heard on issues and the lists, schedules and statements contain information that, when provided to the United States trustee, enable that office to participate effectively in the case. The United States trustee has standing to move to dismiss a chapter 7 or 13 case for failure to file timely the list, schedules or statement required by §521(1) of the Code. See §§707(a)(3) and 1307(c)(9). It is therefore necessary for the United States trustee to receive notice of any extension of time to file such documents. Upon request, the United States trustee also may receive from the trustee or debtor in possession a list of equity security holders.

Notes of Advisory Committee on Rules—1996 Amendment

Subdivision (c) is amended to provide that schedules and statements filed prior to the conversion of a case to another chapter shall be deemed filed in the converted case, whether or not the case was a chapter 7 case prior to conversion. This amendment is in recognition of the 1991 amendments to the Official Forms that abrogated the Chapter 13 Statement and made the same forms for schedules and statements applicable in all cases.

This subdivision also contains a technical correction. The phrase "superseded case" creates the erroneous impression that conversion of a case results in a new case that is distinct from the original case. The effect of conversion of a case is governed by §348 of the Code.

GAP Report on Rule 1007(c). No changes since publication, except for stylistic changes.

Committee Notes on Rules—2001 Amendment

Subdivision (m) is added to enable the person required to mail notices under Rule 2002 to mail them to the appropriate guardian or other representative when the debtor knows that a creditor or other person listed is an infant or incompetent person.

The proper mailing address of the representative is determined in accordance with Rule 7004(b)(2), which requires mailing to the person's dwelling house or usual place of abode or at the place where the person regularly conducts a business or profession.

Changes Made After Publication and Comments. No changes were made.

Committee Notes on Rules—2003 Amendment

[Subdivision (a).] This rule is amended to require the debtor to file a corporate ownership statement setting out the information described in Rule 7007.1. Requiring debtors to file the statement provides the court with an opportunity to make judicial disqualification determinations at the outset of the case. This could reduce problems later in the case by preventing the initial assignment of the case to a judge who holds a financial interest in a parent company of the debtor or some other entity that holds a significant ownership interest in the debtor. Moreover, by including the disclosure statement filing requirement at the commencement of the case, the debtor does not have to make the same disclosure filing each time it is involved in an adversary proceeding throughout the case. The debtor also must file supplemental statements as changes in ownership might arise.

Changes Made After Publication and Comments. No changes since publication.

[Subdivisions (c) and (f).] The rule is amended to add a requirement that a debtor submit a statement setting out the debtor's social security number. The addition is necessary because of the corresponding amendment to Rule 1005 which now provides that the caption of the petition includes only the final four digits of the debtor's social security number. The debtor submits the statement, but it is not filed, nor is it included in the case file. The statement provides the information necessary to include on the service copy of the notice required under Rule 2002(a)(1). It will also provide the information to facilitate the ability of creditors to search the court record by a search of a social security number already in the creditor's possession.

Changes Made After Publication and Comments. The rule amendment is made in response to the extensive commentary that urged the Advisory Committee to continue the obligation contained in current Rule 1005 that a debtor must include his or her social security number on the caption of the bankruptcy petition. Rule 1005 is amended to limit that disclosure to the final four digits of the social security number, and Rule 1007 is amended to reinstate the obligation in a manner that will provide more protection of the debtor's privacy while continuing access to the information to those persons with legitimate need for that data. The debtor must disclose the information, but the method of disclosure is by a verified statement that is submitted to the clerk. The statement is not filed in the case and does not become a part of the court record. Therefore, it enables the clerk to deliver that information to the creditors and the trustee in the case, but it does not become a part of the court record governed by §107 of the Bankruptcy Code and is not available to the public.

Committee Notes on Rules—2005 Amendment

Notice to creditors and other parties in interest is essential to the operation of the bankruptcy system. Sending notice requires a convenient listing of the names and addresses of the entities to whom notice must be sent, and virtually all of the bankruptcy courts have adopted a local rule requiring the submission of a list of these entities with the petition and in a particular format. These lists are commonly called the "mailing matrix."

Given the universal adoption of these local rules, the need for such lists in all cases is apparent. Consequently, the rule is amended to require the debtor to submit such a list at the commencement of the case. This list may be amended when necessary. See Rule 1009(a).

The content of the list is described by reference to Schedules D through H of the Official Forms rather than by reference to creditors or persons holding claims. The cross reference to the Schedules as the source of the names for inclusion in the list ensures that persons such as codebtors or nondebtor parties to executory contracts and unexpired leases will receive appropriate notices in the case.

While this rule renders unnecessary, in part, local rules on the subject, this rule does not direct any particular format or form for the list to take. Local rules still may govern those particulars of the list.

Subdivision (c) is amended to reflect that subdivision (a)(1) no longer requires the debtor to file a schedule of liabilities with the petition in lieu of a list of creditors. The filing of the list is mandatory, and subdivision (b) of the rule requires the filing of schedules. Thus, subdivision (c) no longer needs to account for the possibility that the debtor can delay filing a schedule of liabilities when the petition is accompanied by a list of creditors. Subdivision (c) simply addresses the situation in which the debtor does not file schedules or statements with the petition, and the procedure for seeking an extension of time for filing.

Other changes are stylistic.

Changes Made After Publication and Comment. No changes since publication.

Committee Notes on Rules—2008 Amendment

The title of this rule is expanded to refer to "documents" in conformity with the 2005 amendments to §521 and related provisions of the Bankruptcy Code that include a wider range of documentary requirements.

Subdivision (a) is amended to require that any foreign representative filing a petition for recognition to commence a case under chapter 15, which was added to the Code in 2005, file a list of entities with whom the debtor is engaged in litigation in the United States. The foreign representative filing the petition for recognition must also list any entities against whom provisional relief is being sought as well as all persons or bodies authorized to administer foreign proceedings of the debtor. This should ensure that entities most interested in the case, or their representatives, will receive notice of the petition under Rule 2002(q).

Subdivision (a)(4) is amended to require the foreign representative who files a petition for recognition under chapter 15 to file the documents described in §1515 of the Code as well as a corporate ownership statement. The subdivision is also amended to identify the foreign representative in language that more closely follows the text of the Code. Former subdivision (a)(4) is renumbered as subdivision (a)(5) and stylistic changes were made to the subdivision.

Subdivision (b)(1) addresses schedules, statements, and other documents that the debtor must file unless the court orders otherwise and other than in a case under chapter 9. This subdivision is amended to include documentary requirements added by the 2005 amendments to §521 that apply to the same group of debtors and have the same time limits as the existing requirements of (b)(1). Consistent with the E-Government Act of 2002, Pub. L. No. 107–347, the payment advices should be redacted before they are filed.

Subdivision (b)(2) is amended to conform to the renumbering of the subsections of §521.

Subdivisions (b)(3) through (b)(8) are new and implement the 2005 amendments to the Code. Subdivision (b)(3) provides for the filing of a document relating to the credit counseling requirement provided by the 2005 amendments to §109 in the context of an Official Form that warns the debtor of the consequences of failing to comply with the credit counseling requirement.

Subdivision (b)(4) addresses the filing of information about current monthly income, as defined in §101, for certain chapter 7 debtors and, if required, additional calculations of expenses required by the 2005 amendments to §707(b).

Subdivision (b)(5) addresses the filing of information about current monthly income, as defined in §101, for individual chapter 11 debtors. The 2005 amendments to §1129(a)(15) condition plan confirmation for individual debtors on the commitment of disposable income, as defined in §1325(b)(2), which is based on current monthly income.

Subdivision (b)(6) addresses the filing of information about current monthly income, as defined in §101, for chapter 13 debtors and, if required, additional calculations of expenses. These changes are necessary because the 2005 amendments to §1325 require that the determination of disposable income begin with current monthly income.

Subdivision (b)(7) reflects the 2005 amendments to §§727 and 1328 of the Code that condition the receipt of a discharge on the completion of a personal financial management course, with certain exceptions. Certain individual chapter 11 debtors may also be required to complete a personal financial management course under §727(a)(11) as incorporated by §1141(d)(3)(C). To evidence compliance with that requirement, the subdivision requires the debtor to file the appropriate Official Form certifying that the debtor has completed the personal financial management course.

Subdivision (b)(8) requires an individual debtor in a case under chapter 11, 12, or 13 to file a statement that there are no reasonable grounds to believe that the restrictions on a homestead exemption as set out in §522(q) of the Code are applicable. Sections 1141(d)(5)(C), 1228(f), and 1328(h) each provide that the court shall not enter a discharge order unless it finds that there is no reasonable cause to believe that §522(q) applies. Requiring the debtor to submit a statement to that effect in cases under chapters 11, 12, and 13 in which an exemption is claimed in excess of the amount allowed under §522(q)(1) provides the court with a basis to conclude, in the absence of any contrary information, that §522(q) does not apply. Creditors receive notice under Rule 2002(f)(11) of the time to request postponement of the entry of the discharge to permit an opportunity to challenge the debtor's assertions in the Rule 1007(b)(8) statement in appropriate cases.

Subdivision (c) is amended to include time limits for the filing requirements added to subdivision (b) due to the 2005 amendments to the Code, and to make conforming amendments. Separate time limits are provided for the documentation of credit counseling and for the statement of the completion of the financial management course. While most documents relating to credit counseling must be filed with the voluntary petition, the credit counseling certificate and debt repayment plan can be filed within 15 days of the filing of a voluntary petition if the debtor files a statement under subdivision (b)(3)(B) with the petition. Sections 727(a)(11), 1141(d)(3), and 1328(g) of the Code require individual debtors to complete a personal financial management course prior to the entry of a discharge. The amendment allows the court to enlarge the deadline for the debtor to file the statement of completion. Because no party is harmed by the enlargement, no specific restriction is placed on the court's discretion to enlarge the deadline, even after its expiration.

Subdivision (c) of the rule is also amended to recognize the limitation on the extension of time to file schedules and statements when the debtor is a small business debtor. Section 1116(3), added to the Code in 2005, establishes a specific standard for courts to apply in the event that the debtor in possession or the trustee seeks an extension for filing these forms for a period beyond 30 days after the order for relief.

Changes Made After Publication. Subdivision (a)(4) was amended to insert the requirement that the foreign representative who files the chapter 15 petition must file the corporate ownership statement. Subdivision (b)(4) was amended to provide that all individual debtors rather than just those whose debts are primarily consumer debts must file the statement of current monthly income. Subdivisions (b)(7) and (c) were amended to make the obligation to file a statement of the completion of a personal financial management course applicable to certain individual chapter 11 debtors as well as to individual debtors in chapters 7 and 13. Subdivision (c) is also amended to provide the court with broad discretion to enlarge the time to file the statement of completion of a personal financial management course. The Committee Note was amended to explain these changes.

Committee Notes on Rules—2009 Amendment

The rule is amended to implement changes in connection with the amendment to Rule 9006(a) and the manner by which time is computed under the rules. Each deadline in the rule of fewer than 30 days is amended to substitute a deadline that is a multiple of seven days. Throughout the rules, deadlines are amended in the following manner:

• 5-day periods become 7-day periods

• 10-day periods become 14-day periods

• 15-day periods become 14-day periods

• 20-day periods become 21-day periods

• 25-day periods become 28-day periods

Committee Notes on Rules—2010 Amendment

Subdivision (a)(2). Subdivision (a)(2) is amended to shorten the time for a debtor to file a list of the creditors included on the various schedules filed or to be filed in the case. This list provides the information necessary for the clerk to provide notice of the §341meeting of creditors in a timely manner.

Subdivision (c). Subdivision (c) is amended to provide additional time for individual debtors in chapter 7 to file the statement of completion of a course in personal financial management. This change is made in conjunction with an amendment to Rule 5009 requiring the clerk to provide notice to debtors of the consequences of not filing the statement in a timely manner.

Changes Made After Publication. No changes since publication.

Committee Notes on Rules—2012 Amendment

Subdivision (c). In subdivision (c), the time limit for a debtor in an involuntary case to file the list required by subdivision (a)(2) is deleted as unnecessary. Subdivision (a)(2) provides that the list must be filed within seven days after the entry of the order for relief. The other change to subdivision (c) is stylistic.

Committee Notes on Rules—2013 Amendment

Subdivision (b)(7) is amended to relieve an individual debtor of the obligation to file a statement of completion of a personal financial management course if the course provider notifies the court that the debtor has completed the course. Course providers approved under §111 of the Code may be permitted to file this notification electronically with the court immediately upon the debtor's completion of the course. If the provider does not notify the court, the debtor must file the statement, prepared as prescribed by the appropriate Official Form, within the time period specified by subdivision (c).

Changes Made After Publication and Comment. No changes were made after publication and comment.

Committee Notes on Rules—2015 Amendment

In subdivisions (a)(1) and (a)(2), the references to Schedules are amended to reflect the new designations adopted as part of the Forms Modernization Project.

Committee Notes on Rules—2022 Amendment

The rule is amended in response to the enactment of the Small Business Reorganization Act of 2019, Pub. L. No. 116–54, 133 Stat. 1079. That law gives a small business debtor the option of electing to be a debtor under subchapter V of chapter 11. As amended, subdivision (b)(5) of the rule includes an exception for subchapter V cases. Because Code §1129(a)(15) is inapplicable to such cases, there is no need for an individual debtor in a subchapter V case to file a statement of current monthly income.

Subdivision (h) is amended to provide that the duty to file a supplemental schedule under the rule terminates upon confirmation of the plan in a subchapter V case, unless the plan is confirmed under §1191(b), in which case it terminates upon discharge as provided in §1192.

Committee Notes on Rules—2024 Amendment

The language of Rule 1007 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Additionally, the following substantive changes have been made.

Rule 1007(b)(7) is amended in two ways. First, language is added to make the rule inapplicable to debtors who are not required to complete an instructional course concerning personal financial management as a condition to discharge. See 11 U.S.C. §§727(a)(11), 1328(g)(2), 1141(d)(3)(C). Second, the rule is amended to require an individual debtor who has completed an instructional course concerning personal financial management to file the certificate of course completion (often called a Certificate of Debtor Education) issued by the approved provider of that course in lieu of filing an Official Form, if the provider has not notified the court that the debtor has completed the course.

The amendment to Rule 1007(c)(4) reflects the amendment to Rule 1007(b)(7) described above.

Rule 1008. Requirement to Verify Petitions and Accompanying Documents

A petition, list, schedule, statement, and any amendment must be verified or must contain an unsworn declaration under 28 U.S.C. §1746.

(As amended Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

This rule retains the requirement under the Bankruptcy Act and rules that petitions and accompanying papers must be verified. Only the original need be signed and verified, but the copies must be conformed to the original. See Rule 9011(c).

The verification may be replaced by an unsworn declaration as provided in 28 U.S.C. §1746. See also, Official Form No. 1 and Advisory Committee Note.

Notes of Advisory Committee on Rules—1991 Amendment

The amendments to this rule are stylistic.

Committee Notes on Rules—2024 Amendment

The language of Rule 1008 has been amended as part of the general restyling of the Bankruptcy Rules to make them more easily understood and to make style and terminology consistent throughout the rules. These changes are intended to be stylistic only.

Rule 1009. Amending a Voluntary Petition, List, Schedule, or Statement

(a)

(1) By a Debtor. A debtor may amend a voluntary petition, list, schedule, or statement at any time before the case is closed. The debtor must give notice of the amendment to the trustee and any affected entity.

(2) By a Party in Interest. On a party in interest's motion and after notice and a hearing, the court may order a voluntary petition, list, schedule, or statement to be amended. The clerk must give notice of the amendment to entities that the court designates.

(b)

(c)

(1) promptly submit an amended verified statement with the correct number (Form 121); and

(2) give notice of the amendment to all entities required to be listed under Rule 1007(a)(1) or (a)(2).

(d)

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 30, 1991, eff. Aug. 1, 1991; Apr. 12, 2006, eff. Dec. 1, 2006; Apr. 23, 2008, eff. Dec. 1, 2008; Apr. 2, 2024, eff. Dec. 1, 2024.)

Notes of Advisory Committee on Rules—1983

This rule continues the permissive approach adopted by former Bankruptcy Rule 110 to amendments of voluntary petitions and accompanying papers. Notice of any amendment is required to be given to the trustee. This is particularly important with respect to any amendment of the schedule of property affecting the debtor's claim of exemptions. Notice of any amendment of the schedule of liabilities is to be given to any creditor whose claim is changed or newly listed.

The rule does not continue the provision permitting the court to order an amendment on its own initiative. Absent a request in some form by a party in interest, the court should not be involved in administrative matters affecting the estate.

If a list or schedule is amended to include an additional creditor, the effect on the dischargeability of the creditor's claim is governed by the provisions of §523(a)(3) of the Code.

Notes of Advisory Committee on Rules—1987 Amendment

Subdivision (a) is amended to require notice and a hearing in the event a party in interest other than the debtor seeks to amend. The number of copies of the amendment will be determined by local rule of court.

Subdivision (b) is added to treat amendments of the statement of intention separately from other amendments. The intention of the individual debtor must be performed within 45 days of the filing of the statement, unless the court extends the period. Subdivision (b) limits the time for amendment to the time for performance under §521(2)(B) of the Code or any extension granted by the court.

Notes of Advisory Committee on Rules—1991 Amendment

The amendments to subdivision (a) are stylistic.

Subdivision (c) is derived from Rule X–1002(a) and is designed to provide the United States trustee with current information to enable that office to participate effectively in the case.

Committee Notes on Rules—2006 Amendment

Subdivision (c). Rule 2002(a)(1) provides that the notice of the §341 meeting of creditors include the debtor's social security number. It provides creditors with the full number while limiting publication of the social security number otherwise to the final four digits of the number to protect the debtor's identity from others who do not have the same need for that information. If, however, the social security number that the debtor submitted under Rule 1007(f) is incorrect, then the only notice to the entities contained on the list filed under Rule 1007(a)(1) or (a)(2) would be incorrect. This amendment adds a new subdivision (c) that directs the debtor to submit a verified amended statement of social security number and to give notice of the new statement to all entities in the case who received the notice containing the erroneous social security number.

Subdivision (d). Former subdivision (c) becomes subdivision (d) and is amended to include new subdivision (c) amendments in the list of documents that the clerk must transmit to the United States trustee.

Other amendments are stylistic.

Changes Made After Publication. No changes since publication.

Committee Notes on Rules—2008 Amendment

Subdivision (b) is amended to conform to the 2005 amendments to §521 of the Code.

Changes Made After Publication. No changes were made after publication.

Committee Notes on Rules—2024 Amendment